Capital Gains Exemption

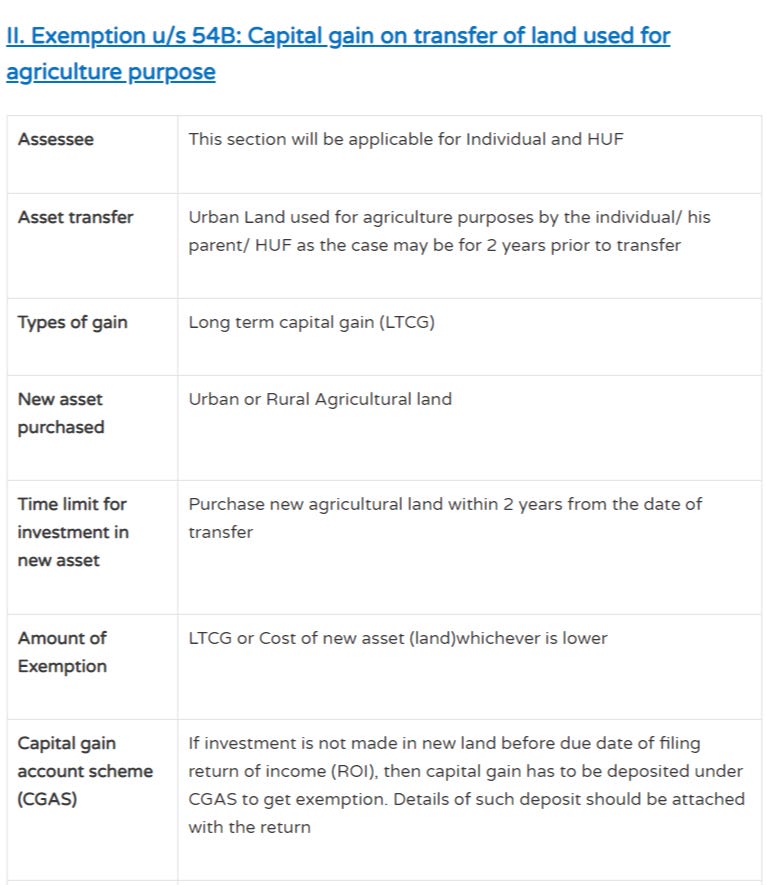

Example: Suppose a long-term agricultural land is transferred by an individual on April 16, 2020

Then to claim exemption under this section assessee must:

Purchase another agricultural land within April 16, 2022

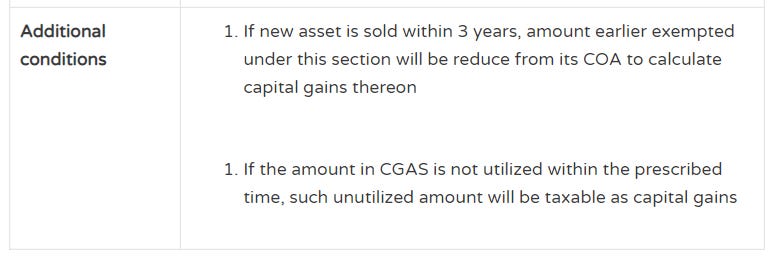

Example: Suppose a long-term land or building used in an industrial undertaking is compulsorily acquired on April 20, 2020 & compensation is received on September 15, 2020

Then to claim exemption under this section assessee must:

Purchase another land or building for the use of same purpose within September 15, 2023

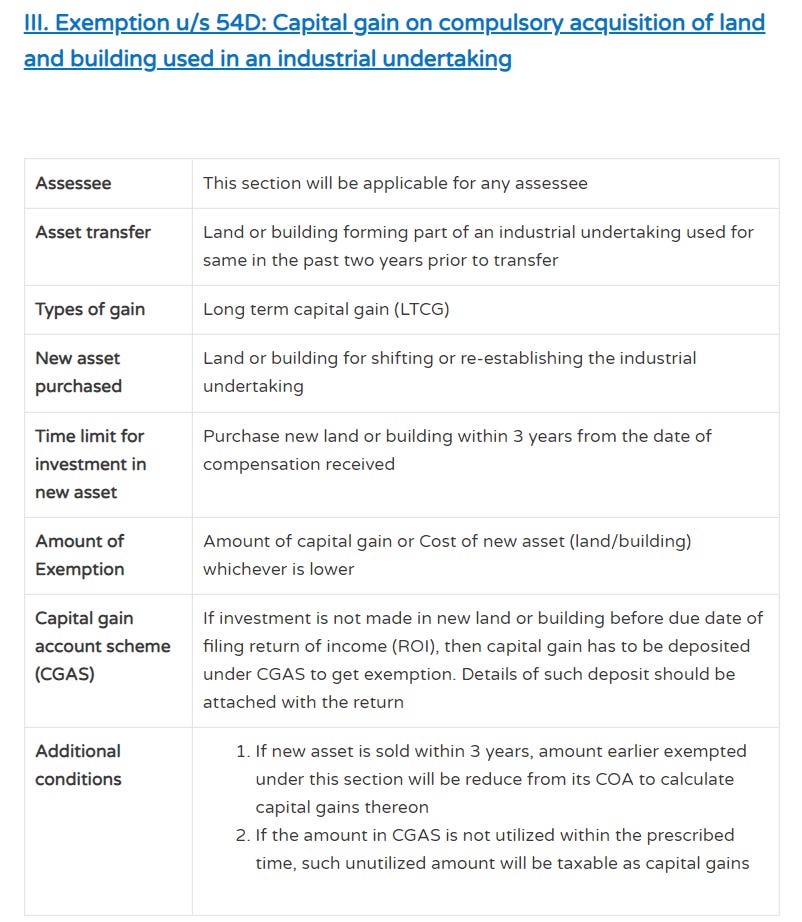

Example: Suppose long term land or building or both is transferred by an assessee on April 5, 2020

Then to claim exemption under this section assessee must:

Invest in specified bonds within Oct 5, 2020

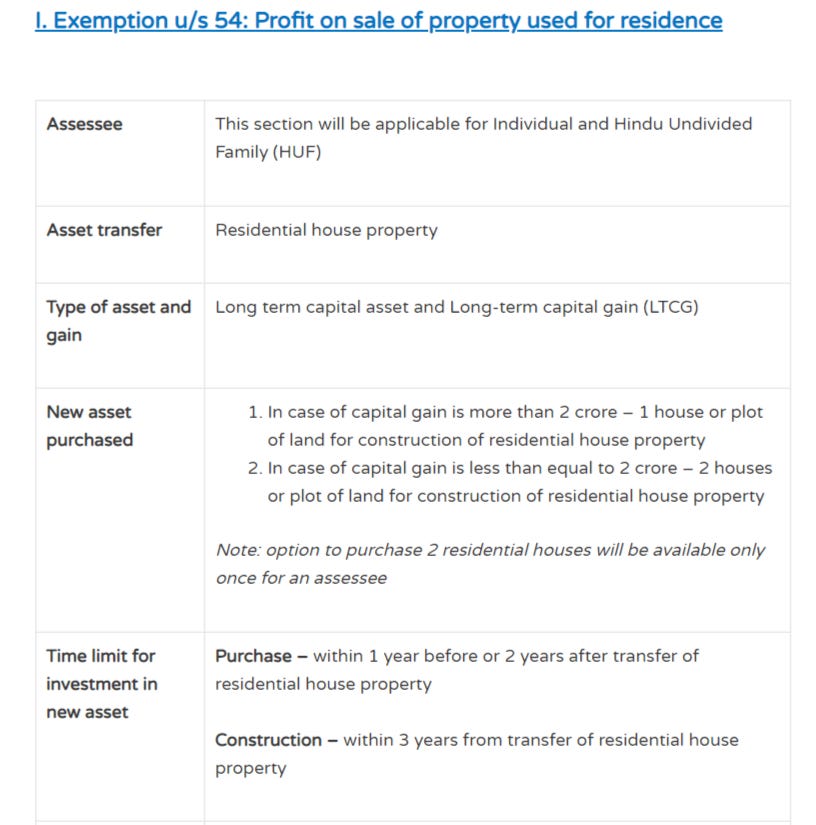

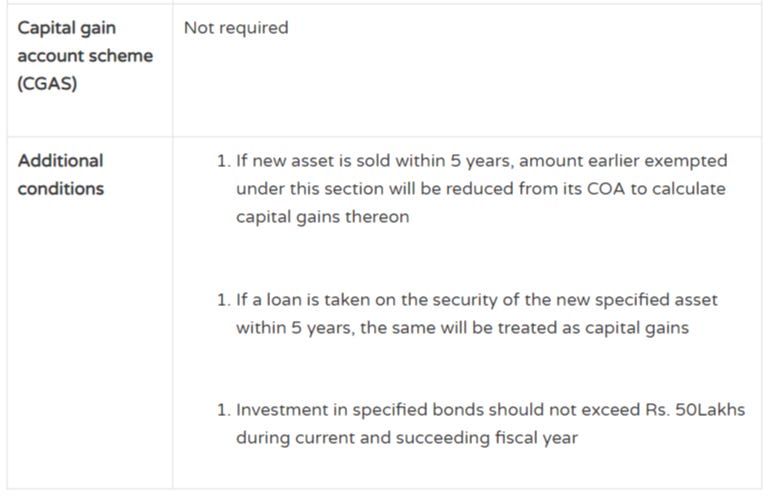

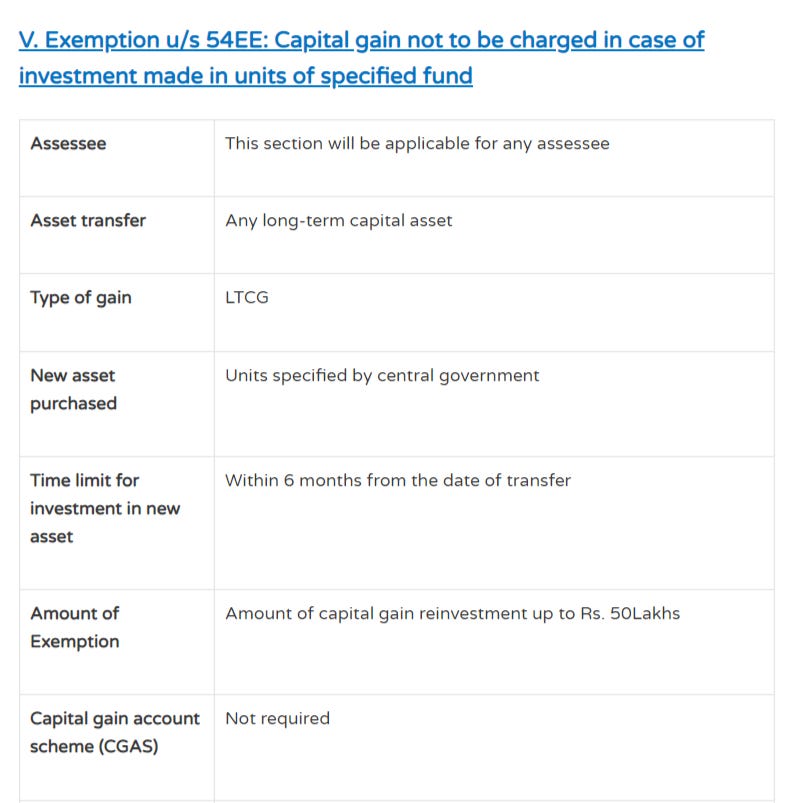

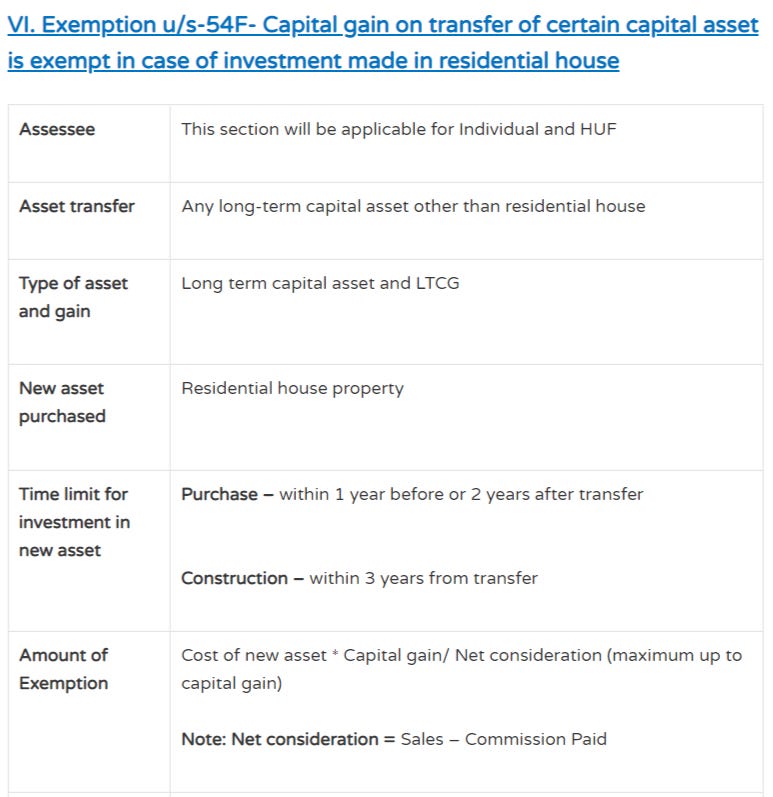

Example: Suppose a long-term capital asset is transferred on April 10, 2020

Then to claim exemption under this section assessee must:

Purchase: New house within April 10, 2019 before original transfer or within April 2022 after transfer

Construct: New house within April 10, 2023 after original transfer