Difference Between 2A vs 2B

Difference Between 2A vs 2B

Index

Let’s understand what is Form GSTR-2A

GSTR 2A is a purchase-related tax return that is automatically generated for each business by the GST portal. GSTR-2a is a read only document. It cannot be edited/modified by the buyer. If there is any discrepancy then the buyer shall contact seller for modification.

When a seller files his GSTR-1, the information is captured in GSTR 2A, it takes information of goods and/or services which have been purchased in a given month from the seller’s GSTR-1. GSTR-2A reflects in purchaser/buyer’s account.

Matching of input tax credit and other details reflecting in GSTR-2A with purchase bills.

Sometimes there is a difference between the two due to various reasons eg. non-uploading of Invoices, mistake in the amounts in Invoices etc. In those cases, buyer shall contact seller for correction. Also ensure the same is reflected next month.

For example, the seller wrongly filed some of the amounts in his GSTR-1 for the period of January. Therefore, while matching GSTR 3B with purchase bills, there would be inconstancies between the two. In the case, buyer shall contact seller and ask for modifications

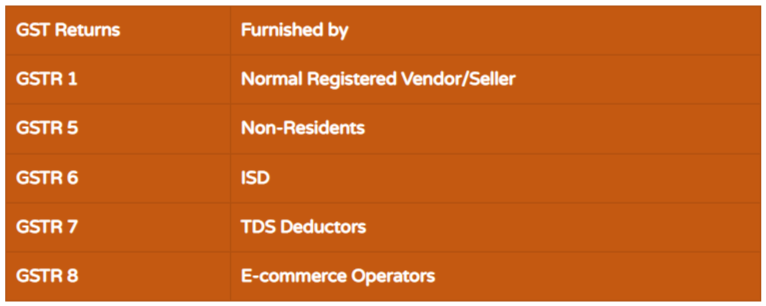

GSTR-2A will be auto-generated from the following Returns:

Objectives of Form GSTR-2A

Help the taxpayers claim 100% ITC in GSTR-3B as being reflected in the GSTR-2A so that genuine ITC claims are not missed out.

Multi-month GSTR-2A report assists businesses to reconcile the input tax credit claimed across the tax periods in a financial year.

Some businesses file GST returns in GSTR-1 monthly whereas some file it quarterly. This leads to a delay in reconciliation exercise by a business especially, when the supplier is filing quarterly GSTR-1 as compared to business filing GSTR-3B regularly every month

Contents of GSTR 2A?

1. GSTIN – The 15-digit GSTIN of such business 2. Name of the Taxpayer – The registered person’s legal name and trade name (if any)

Part A

3. Invoice details of inward supplies that a business received from a registered person, except supplies that attract a reverse charge. It is presented in the following format.

4. Inward supplies on which the reverse charge attracts tax. It’s presented in similar format as 3

5. All Debit/Credit notes and any modification received thereof in the current period. It’s illustrated in the following format.

Part B

6. IDS credit received (including amendments thereof) – It is applicable for Input Service Distributors and its branches. This title shows the credit of ISD and any modification in the current tax period.

Part C

7. TDS and TCS credit received (including amendments thereof) – it is applicable for businesses involved in TDS transactions or selling online via an e-commerce platform.

Whether GSTR-2A need to be filed?

One cannot file GSTR-2A.

It is auto populated return based on other forms.

So, a business need not to file it. Also, since it is generated automatically, there’s no due date in question.

Steps to view GSTR-2A?

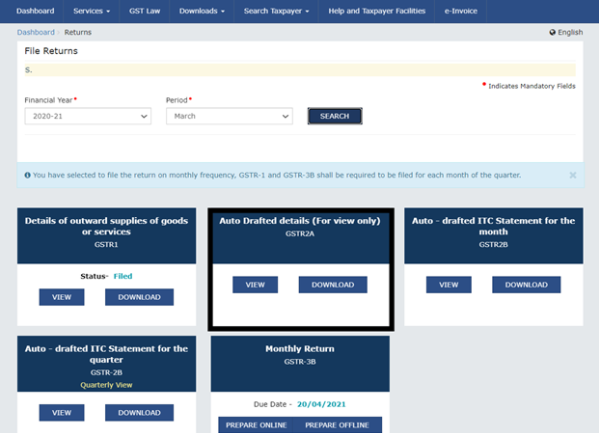

Login to official GST portal

Click on “services” on the dashboard

Click on “Returns” and then “Return Dashboard”

It will show the “File Returns” page, where one needs to fill the “Financial Year” and “Return Filing Period” and then click on Search.

Then click on “view” option under GSTR 2A.

Let’s understand what is Form GSTR-2B

GSTR-2B is an auto-drafted ITC statement generated for the buyer on the basis of the Information furnished by his suppliers.

It also contains information on import of goods from the ICEGATE system including inward supplies of goods received from Special Economic Zones Units / Developers.

Benefits of introducing Form GSTR-2B

It will help in reduction in time taken for preparing return, minimizing errors, assist reconciliation & simplify compliance relating to filing of return.

It can easily be synchronized with your regular tax workflow.

Features of Form GSTR-2B

Form GSTR 2B return is generated monthly, just like the other GST return filing forms.

A PDF and email feature is also added to the form for the ease of assessee. The form will show whether ITC is available to the assessee or not.

The form will summarise the ITC credits attached with GSTR 3B

The assessee can download the form in PDF or EXCEL file form anytime he wants

The advance search and filter option in the form will also help the assessee to view documents beyond 1,000 records.

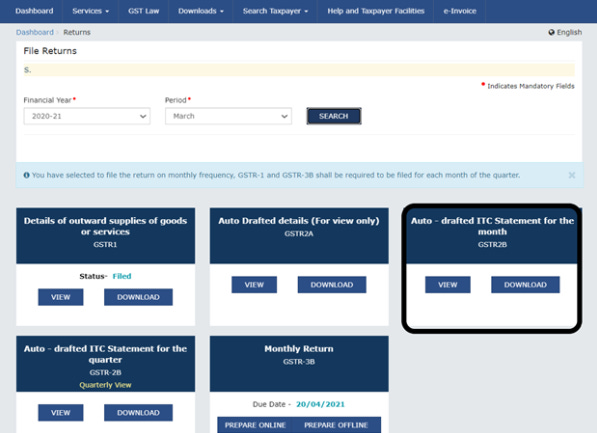

Steps to view GSTR-2B?

Taxpayers can access their GSTR-2B through:

Step 1: Log in to the GST portal using credentials to login.

Step 2: Navigate to the ‘Returns Dashboard’.

Step 3: Select the tax period for which GSTR 2B is required to access.

Step 4: Following screen will appear:

Step 5: Click on the ‘Download’ button to save the statement on your system.

It can also be downloaded- Just click on the download option. If data has more than 1000 records then its cannot be viewed, it has to be downloaded

Excel file can be immediately downloaded, unlike GSTR-2A where in file is generated and excel is available after 20 minutes.

Comparison B/W Auto-populated GSTR 2A and GSTR 2B

Should Input Tax Credit be claimed as per GSTR-2A or GSTR-2B?

The Supplier shall file GSTR-1 for all the services or goods or both which he has sold to the Recipient.

GSTR-1 also popularly called ‘Outward Supplies Details‘ will be filed by the 11th of the subsequent month.

Based on this, the ITC details will get auto-populated in the Recipient’s GSTR-2A.

Now the same Input Tax Credit details get auto-populated in the new form called GSTR-2B.

GSTR-2B can be generated by the recipient every month based on the GSTR-1 filed by their suppliers.

It gives you a complete idea about the eligible and ineligible Input Tax Credit for that particular month.

Generated on the 12th of every month next to the tax period.

GSTR-2B remains constant for a period, unlike the GSTR-2A.

GSTR-2B is available for Normal taxpayers, Casual taxpayers as well as the Special Economic Zones (SEZs).

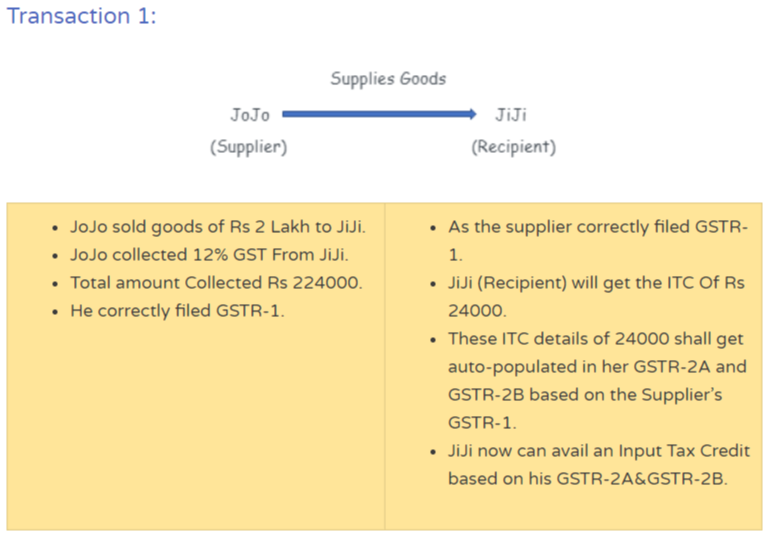

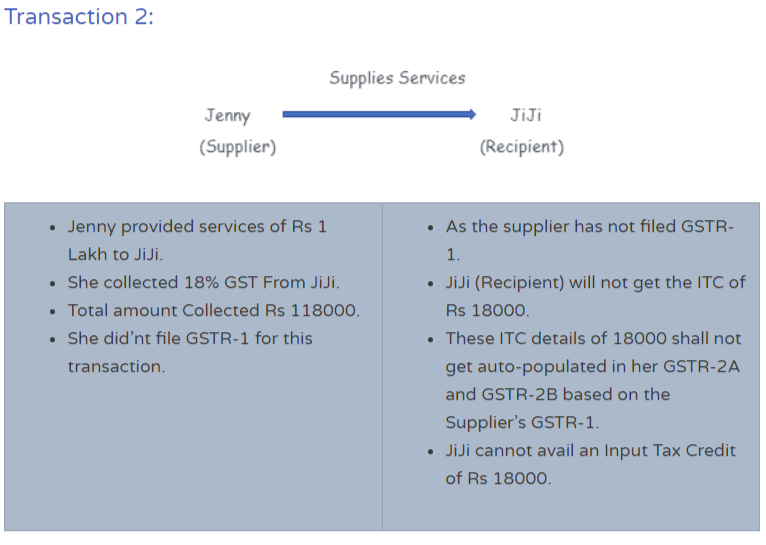

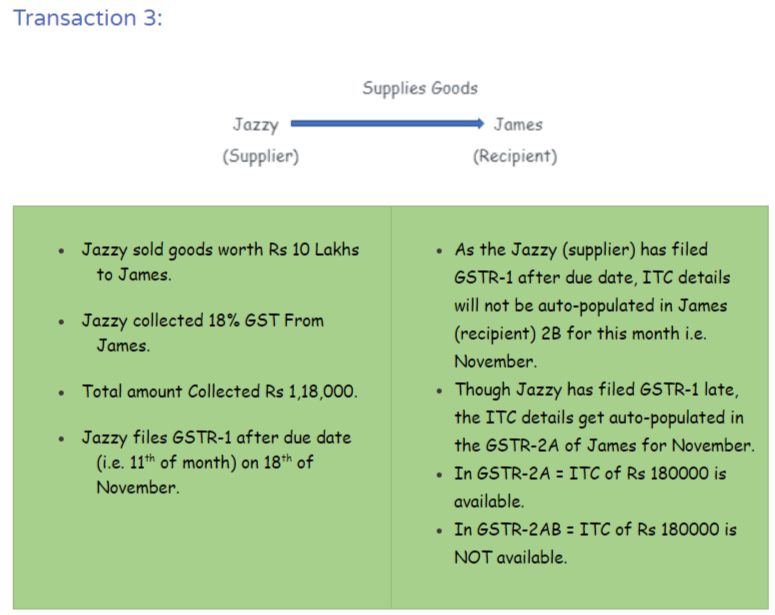

Let us understand with examples:

Based on above transactions Let’s understand the following things.

What is the eligible ITC of JiJi (Recipient) as per Books?

24,000 + 18,000 = INR 42,000.

But how much ITC is available in GSTR-2A as well as 2B of JiJi?

Only INR 24,000.

As 18,000 is not reflected in 2A&2B of JiJi..

Now how Input Tax Credit can be availed by JiJi in her GSTR-3B ?

Here, Rule 36 (4) of the CGST Act, 2017 comes into the picture.

This rule simply states that,

Maximum Eligible ITC for the Recipient shall be.

Eligible ITC auto-populated in GSTR-2B + 5% of eligible ITC

i.e. the Maximum permissible ITC, JiJi can take for this month shall be,

24,000 + 5% of 24,000 = 24,000 + 1,200 = INR 25,200

The remaining Input Tax Credit of INR 18,000 can be availed by JiJi when the defaulting Supplier Jenny will file her GSTR-1.

What is the confusion regarding availing of ITC as per GSTR-2A or GSTR-2B?

Suppose, JiJi purchases goods worth INR 10 lac from a Supplier.

Now there is confusion among the Recipient, whether he shall avail the ITC in his GSTR-3B as per his GSTR-2A in the current month i.e. November, or should avail the ITC as per his GSTR-2B in the next month i.e. December?

The CBIC has clarified that the Input Tax Credit MUST BE AVAILED as per the invoice details available in GSTR-2B.

The invoice details in the GSTR-2A shall not be used to avail of the Input Tax Credit.

Whatever details you have to check in regards to your Input Tax Credit details, you MUST refer to GSTR-2B Reconciliation only.