High Value Transaction

INTRODUCTION

The transactions incurred in high denomination are known as High Value Transactions. Taxpayers are required to keep in mind high-value transactions that they have made during the financial year while filing their income tax return.

Income Tax Department is procuring financial information from other government departments to trace all the persons who have spent huge amounts but have not filed their income tax return (ITR) or under-reported their income in spite of entering into high value transactions or not paid taxes according to the income earned. Reporting Authorities like banks, post office, Registrars are required to intimate about high value transactions to Income-tax by filing Form 61A called Statement of Financial Transaction.

The income tax department has recently launched a revised Form 26AS which is an annual tax statement that reflects details of all high-value transactions of a taxpayer.

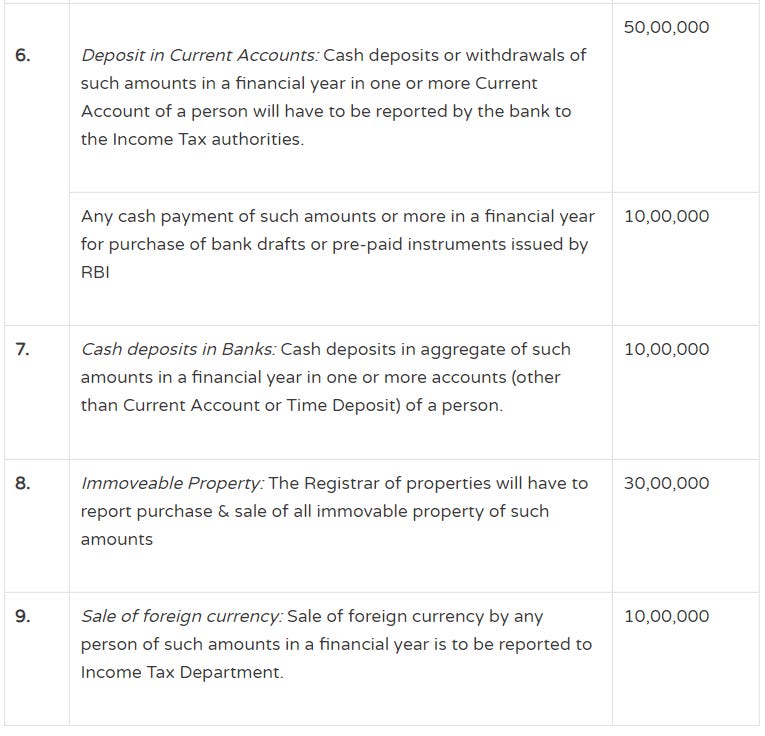

VARIOUS HIGH VALUE TRANSACTIONS

e-Campaign for High value transaction in compliance portal

Income Tax department has formally launched compliance portal and started e-Campaign for certain tax payers. An e-mail is sent to tax payers who have not filed their income tax return or not reported high value transactions in their income tax returns. Income tax department has gathered data from various sources and based on the data, e-Campaign e-mail is sent. This compliance facility has been started from FY 2019-2020 (AY 2020-21).

How information is gathered by Income Tax Department for e-Campaign?

The prime source of collecting information is the bank account of the tax payers, as bank account of the tax payer is linked with Aadhaar.

Income Tax Department also collects information from Statement of financial transaction (SFT) which is submitted by various specified entities like Bank, NBFC, Recognised Stock Exchange to Income tax department.

Tax Deducted at source (TDS), Tax Collected at source (TCS), Foreign remittance etc.

Other methods to extract information is GST, export, import, real estate transactions.

What is Income Tax Compliance Portal?

Income Tax compliance portal is a website where tax payer can provide response to the compliance. This is to avoid notice, scrutiny, and other actions from the income tax department.

How to submit response on Income Tax Compliance Portal?

Login: Login to the e-filing portal (https://incometaxindiaefiling.gov.in) and click on the ‘Compliance Portal’. Link is available in ‘My Account’ to navigate to Compliance portal (https://compliance.insight.gov.in).

View information details: Click on the ‘e-Campaign’- High Value Transaction’ tab to view information details.

Submit Response: Tax payer have to submit online response by selecting among the following options on Compliance Portal.

Following responses can be selected:

Net steps after submitting response to he Income tax compliance portal

Once you submit the response on the portal, you need to take action with respect to revising income tax return. Along with revising income tax return, you need to pay self-assessment tax (if any).

In case date of revising income tax return has passed, you need to wait till the time income tax department generates demand on the portal. You need to pay tax on the generated demand to close your income tax liability.