Income Tax Return – Forms & It’s applicability for FY-2020-21

Index

Who is required to file ITR?

Conditional filing of Return:

Assessee whose Gross Total Income (i.e income before claiming exemption u/s 54, 54B, 54D, 54EC, 54F, 54G, 54GA, 54GB and deduction Under Chapter VI-A) is more than the basic exemption limit then the assessee is required to file its ITR.

Compulsorily filing of Return:

Company & Partnership Firm (including LLP) are required to file their ITR mandatorily (i.e even if they incurred loss ITR is required to be filed)

Resident individual who is the beneficial owner of any asset located outside India or has signing authority of any Account outside India

Resident individual who is beneficiary of any asset located outside India

Resident individual has deposited an amount more than one crore in aggregate in one or more current account maintain with banks or cooperative bank, or

He has incurred foreign travel expenditure of Rs.200000 or more for himself or any other person, or

He had incurred electricity expenditure of more than Rs.100000

Who will file which ITR Form

ITR-1

ITR-1 is for resident individual whose total income includes :

Income from Salary or Pension; or

Income from one House Property (except the cases where loss from previous year is carry forward); or

Income from Other Sources (except Winning from Lottery and Income from Race Horses)

(Total income from the above sources should not be more than 50 Lakhs)

Income from Agriculture up to Rs.5000

ITR-2

ITR-2 is for Individual or Hindu Undivided Family (HUF) whose total income includes:

Income from Salary or Pension; or

Income from House Property; or

Income from Other Sources (including Winnings from Lottery and Income from Race Horses)

(Total income from the above sources should be more than 50 Lakhs)

If you are a Director of a company (not having income from Business or Profession)

If you have investments in unlisted equity shares at any time during the financial year

Income from Capital gain; or

Income from Agriculture more than Rs.5000

Having any Foreign Asset or Foreign Income

Being a non resident and resident not ordinarily resident (RNOR)

ITR-3

ITR-3 is for Individuals and Hindu Undivided Family having income from proprietary business or carrying on profession with following sources of income :

Income from Business and Profession

If you are a Director of a company

If you are a partner of a firm having income from partnership firm and not opting for Presumptive taxation

If you have investments in unlisted equity shares at any time during the financial year

This return may include income from House Property, Salary/Pension and Income from other sources

ITR-4

ITR-4 is for Individuals, Hindu Undivided Family and Firms (other than LLP) being a resident with income:

Up to Rs.50 Lakhs and

Income from business and profession which is computed Under Section 44AD, 44ADA, 44AE

ITR-5

ITR-5 is applicable for firms, Limited Liability Partnership (LLP), Association of Persons(AOP), Body of Individuals(BOI), Artificial Juridical Person (AJP)

ITR-6

ITR-6 is applicable for Companies other than Companies claiming exemption Under Section 11 i.e Income from property held for charitable or religious purposes

ITR-7

ITR-7 is applicable for persons falling Under Section

139(4a) related with trust income

139(4b) deals with political parties

139(4c) deals with scientific research

139(4d) related with the university and college

Due dates for ITR for different person

ITR forms and utility

ITR forms:

CBDT notifies all ITR Forms 1 to 7 for AY 2021-22 vide Notification no. 21/2021 in G.S.R 242 ( E) dated March 31 2021.

No significant changes have been made in the ITR forms this year as compared to last year’s Forms.

IRT utility:

Excel and Java version of ITR utilities will be discontinued from AY 2021-22

For AY 2021-22, JSON Utility for ITR-1 to 4 is to be used. Import of prefill file of respective

User ID is mandatory in utility

Offline utility for ITR-1 and ITR-4 are now made available at www.efilingincometax.gov.in

The utility for other ITRs will be enabled shortly

Step by Step guide to download/install and Fill ITR-1 And ITR-4 offline utility for AY 2021-22

User can download the utility as under

Downloads>offline utilities>Income Tax Return Preparation Utilities

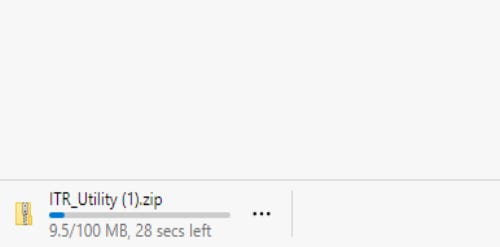

On click of link for the Utility presented against ITR-1 or ITR-4, a ZIP file will start getting downloaded on your system.

Open the Utility from the extracted folder.

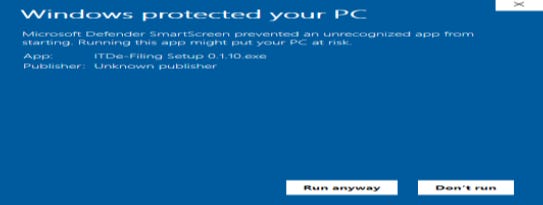

After you Extract the downloaded utility as a ZIP file, open the Utility from the extracted folder. In case, you receive this message, you click “Run Anyway” option in the dialogue box.

Once you click on “Run Anyway”, your utility will start installing, after which you can proceed with filing your ITR.

As soon as you install the utility, you will be landed to Homepage. Click on “Continue” to fill your Income-tax Return for AY 2021-22.

You will find 3 tabs: –

Returns: -If you are filling the return for the first time, click on “File returns” in this tab.

Draft version of returns: -If you have already started to file your return, you can see the draft version of your returns in this tab and click on “edit”.

Pre-filled Data: -It will show you all pre-filled ITR data you had earlier imported into the utility.

After click on “File returns”, select the radio button to “Import pre-filled data”.

On click of this option, the prefilled data already saved by you on your system in json format can be imported to prefill the information in the income tax return.

Enter the “PAN” for whom you want to fill the return and select the “Assessment year” and click on “Proceed”.

Assessment Year 2021-22 can only be selected.

Pre-filled json can be downloaded post loginto the e-Filing portal from:

‘My Account -> ‘Download Pre-Filled for AY 2021-22’ and can be imported to the utility for prefilling the personal and other available details.

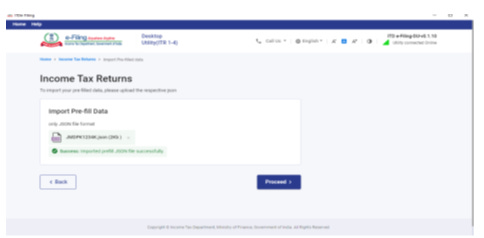

Attach the pre-filled JSON file from your system and click on “proceed”.

On click of Proceed in earlier screen, you will be navigated to “Income Tax Returns” screen, where you can see the Basic pre-filled details from the imported JSON file.

Click on “File Return” to continue.

Select the Status applicable to you and click on “Continue”.

Status will be pre-filled based on your last year’s data and will be editable.

Select the ITR type which you want to file from the dropdown and “Proceed”.

A user-friendly questionnaire to identify ITR applicable to you will be available in subsequent release of the offline utility

Click on “Let’s get started” to start filling your return.

Fill the applicable and mandatory fields of the ITR form -> Validate all the tabs of the ITR form and Tax will be calculated.

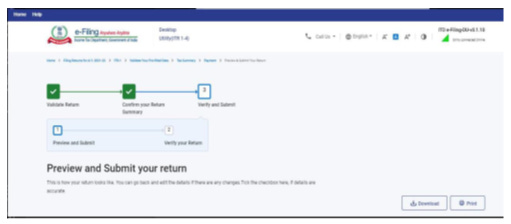

After confirming all the schedules, you can Preview and submit your Return.

You can either “Download” or “Print” the preview by clicking on the respective buttons.

You can download the Preview on your system.

It will be downloaded in pdf format

Click on “Proceed to validation”, to validate the Return.

All the errors needs to be validated by the user after that he can “Download JSON”.

Just click on the error, you will be navigated to the field related to that error.

Note :

Data will be refreshed on Real time basis.

Tax will be calculated on Real time basis.

Data will be Auto Saved.

The downloaded JSON file can be generated and saved on the system for uploading it on the e-filing portal (post enablement of the functionality).