Incorporation of a new company

INCORPORATION OF A NEW COMPANY

In this blog we will discuss:

Prerequisite to incorporate a new company

Documents required

Features of Form SPICe+ (e form to incorporate a company)

Steps to incorporate a company

DSCs

To incorporate a company on MCA portal, DSC must be required for the proposed directors and the shareholders of the company for filing the required e-forms during the registration process.

DIN

To become the director of the proposed company, it is mandatory to obtain the Director Identification Number or the DIN. There are 2 methods through which a DIN can be obtained. They are as follows:

Documents Required

PAN card, Aadhaar Card, & Photo of all directors

Saving Bank a/c statement of all directors

Voter ID/ Driving License/ passport of all directors

Latest electricity bill of Office

Rent Agreement (If premises is Rented)

Memorandum of Association

Articles of Association

To apply for company registration, the SPICe+ form is to be filled and submitted on the MCA portal

SPICe+ key features are:

SPICe+ is an integrated Web based form.

SPICe+ has two parts viz.: Part A-for Name reservation for new companies and Part B offering a bouquet of services viz.

Incorporation

DIN allotment

Mandatory issue of PAN

Mandatory issue of TAN

Mandatory issue of EPFO registration

Mandatory issue of ESIC registration

Mandatory issue of Professional Tax registration (Maharashtra)

Mandatory Opening of Bank Account for the Company and

Allotment of GSTIN (if applied for)

Users may choose to submit Part-A for reserving a name first and thereafter submit Part B for incorporation & other services or file Part A and B together at one go.

Approved name and related incorporation details as submitted in Part A & Part B respectively, would be automatically pre-filled in INC-9. Other linked forms will have to be filled i.e., AGILE-PRO, e-MoA, e-AoA, URC-1.

Once the SPICe+ form is filled completely with all the relevant details, pre-scrutize the form, download the pdf version generated on the website and after downloading the final form, affix the DSC and upload the form.

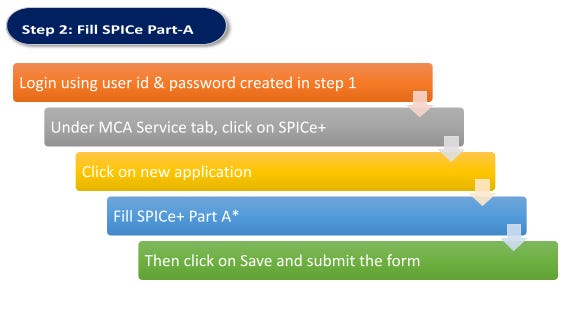

STEPS TO INCORPORATE A PRIVATE LIMITED COMPANY

*Under proposed name, enter the name you want to reserve for the company and click on auto-check to confirm whether the name is available or not.

After submitting the form, a dialog box will appear asking for ‘Submit for name approval’ or ‘proceed for incorporation’. If you are sure that the that the proposed name is available for your company on MCA, then click on Proceed for incorporation, otherwise click on Submit for name Reservation.

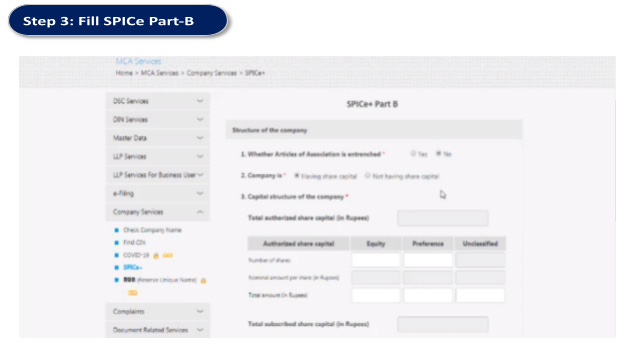

If opted for ‘Proceed for incorporation, Part B of the web form gets enabled which will have different sections.

Enter the basic details related to the company to be incorporated viz. –

Registered or Correspondence Address –

Subscribers and director’s details –

Details related to capital etc.

Enter basic details for issuance of Permanent Account Number (PAN) and Tax Deduction Account number (TAN).

Upload mandatory attachments in web form.

Confirm the relevant declarations and click on pre-scrutiny.

Once pre-scrutiny is successful, click on submit button.

Once web form is submitted successfully, user will get a confirmation message.

User can then download SPICe+ Part B PDF from the Dashboard for affixing DSCs. Subsequently, all the relevant linked forms get enabled and are made available for the user to fill and submit based on the fields/parameters entered by the user in Part B.

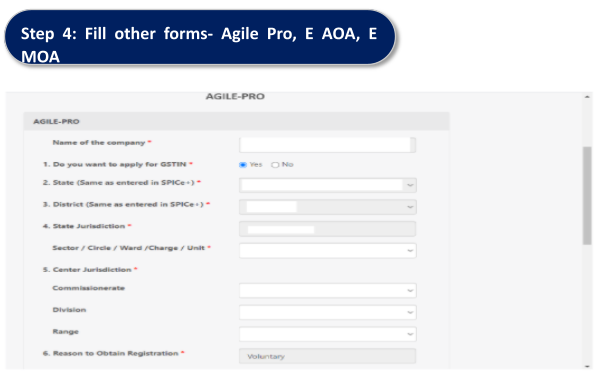

AGILE-PRO needs to be filed as linked eForm with SPICe+ for: Registration with GSTN Registration with ESIC Registration with EPFO Professional tax registration number Bank account number

Registration with GSTN

Registration with ESIC

Registration with EPFO

Professional tax registration number

Bank account number

Electronic Memorandum of Association (eMoA) which is a Charter of the company can be filed as a linked form to SPICe+

Electronic Articles of Association (eAoA) which provide all the regulations related to internal affairs of the company can be filed as a linked form to SPICe+

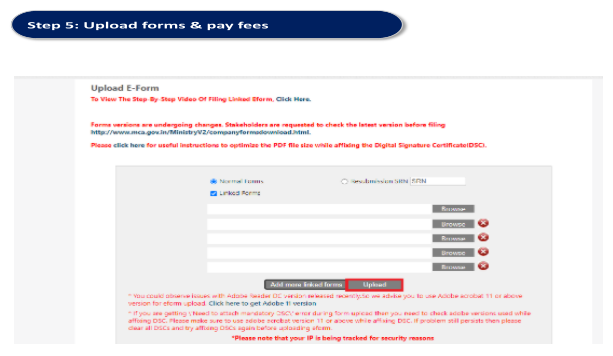

After filing & submitting all the forms, download all the forms and affix DSCs.

Visit MCA site, click on Upload E-Forms under MCA service tab.

Choose Normal forms, browse and upload SPICe+ Part B PDF and all the relevant linked forms

On successful uploading of forms, Unique Service Request Number (SRN) gets generated and is displayed to the applicant.

System prompts user to make payment.

After successful payment, Work item/SRN gets routed to Back Office user for processing.