India's trajectory mirrors China's historical journey💸

A recent report by Goldman Sachs predicted that ‘Affluent India’ will grow over 10 crore by the year 2027. The report also stated that the property prices rose 30% over FY 19-23, compared to an increase of 13% over FY 15-19.

Agar app bhi participate karna chahte hai India ki growth story mein, without breaking the bank and find comfort in real estate investments then Infrastructure Investment Trust (InvITs) should interest you.

What are InvITs?

InvITs are innovative investment vehicles that offer regular income and growth potential along with the underlying stability that comes from investing in infrastructure assets. InvITs allow even small investors to gain exposure to large road, power, and other infrastructure projects while providing these projects access to cheaper and long-term capital.

Indian InvIT abhi budding stage par hai but holds immense promise. Inspired by the success of REITs (real estate investment trusts), the first InvIT was launched by IRB Infrastructure Developers in 2017. Since then, the market has slowly but steadily grown with around 10 InvITs now trading on the Indian bourses. However, the market remains highly under-penetrated compared to other large economies.

InvITs make up less than 1% of India's GDP, compared to around 15% in the USA and 7% in China.

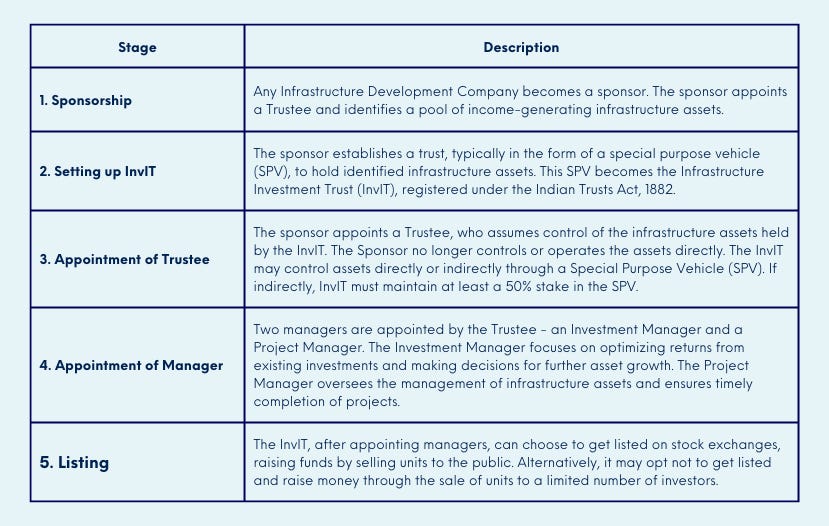

How is an InvIT established?

The manner in which an InvIT is structured reflects a regulated investment avenue, which provides opportunities for investors to participate in India's infrastructure growth while offering a transparent and organized mechanism for asset monetization.

What are the InvIT Rules in India?

The Securities Exchange Board of India (SEBI) first allowed the creation of Infrastructure Investment Trusts (InvITs) in 2014 as an alternative investment option. As of September 2023, there are 22 InvITs registered with SEBI. Some key regulations for InvITs in India are:

● An InvIT must invest a minimum of 80% of its total assets in completed and revenue-generating infrastructure projects. Up to 20% can be invested in under-construction projects and other approved financial instruments.

● InvITs need to distribute at least 90% of their income as dividends to unit holders every 6 months. This ensures a regular income for investors.

● InvITs can invest in roads, power, telecom, and other infrastructure projects to provide investors exposure to the infrastructure sector.

● SEBI regulations aim to bring transparency and governance standards to the InvIT market. All projects must have stable cash flows for inclusion in an InvIT's portfolio.

How Do InvITs Generate Returns for Investors?

Infrastructure Investment Trusts (InvITs) can provide attractive returns to investors through multiple avenues. Firstly, they invest in operational infrastructure assets like roads, power transmission lines, and telecom towers that have predictable cash flows based on long-term contracts. These stable revenue streams allow InvITs to distribute a major share of the income as dividends to unit holders.

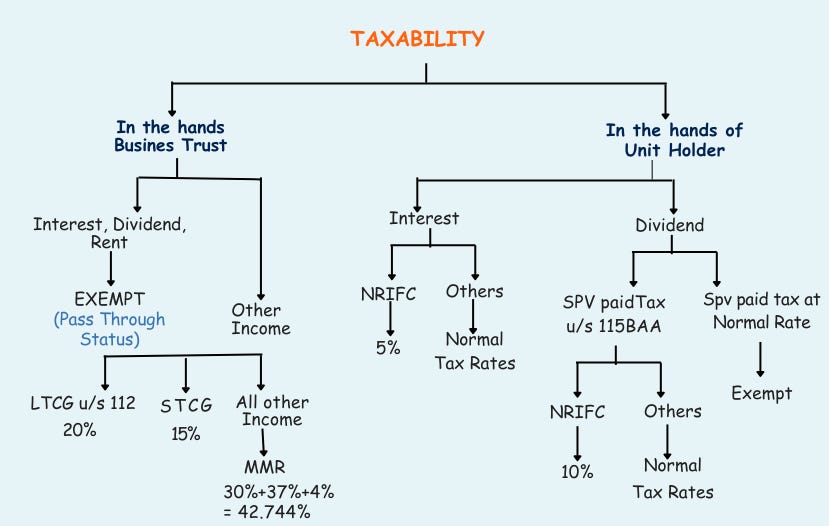

Secondly, as infrastructure projects mature, they are able to increase tariffs over time based on contractual terms. This leads to appreciation in the valuation of the underlying assets, providing capital gains to the InvIT investors. InvITs also utilize debt financing to enhance returns through financial leverage. The stable cash flows allow them to comfortably service interest costs on debt and provide higher returns on the equity capital invested. Moreover, InvITs enjoy tax efficiency as they avoid double taxation of income that is distributed to unit holders.

Finally, India's massive investments planned in infrastructure provide InvITs opportunities for continued growth and acquisition of new assets, aiding overall returns. The combination of regular income, capital appreciation, leverage, tax efficiency and growth makes InvITs an attractive investment vehicle for those seeking exposure to India's infrastructure story.

Bottom Line

As India stands poised for rapid growth in infrastructure, the need for innovative financing platforms like InvITs cannot be overstated. While still an evolving investment vehicle, InvITs have demonstrated the ability to tap into retail and institutional funds looking for stable yields and diversification.

For investors, InvITs offer an optimal risk-return profile with lower volatility compared to equities, through exposure to tangible assets built on strong contractuality. And by attracting long-term capital to the infrastructure sector, InvITs can play a pivotal role in funding the India of tomorrow.

But InvITs are not without risks. Investors should assess portfolio assets, leverage levels, and promoter quality before investing. Liquidity also remains relatively low at present. However, with increasing scale and maturity, the InvIT market holds exciting potential.

So if you have an appetite for smart infra investing and wish to play the India growth story, it may be worthwhile exploring quality InvITs for your portfolio. Stay abreast of regulatory updates, study offer documents carefully and partner with a trusted advisor like JJ Tax before taking the plunge. Used judiciously, InvITs could provide your investment portfolio the stability of fixed income and the growth of equities – delivering the best of both worlds.