Invest Like a Pro: Do(s) and Don't(s) for Bull and Bear Markets 📉

Opportunities and Risks: A Guide to Investing in Volatile Markets 💫

Are you feeling the heat of the current market volatility? Do you need help with what to do during a bull market versus a bear market? You're not alone. The stock market can be a rollercoaster ride, with its ups and downs creating opportunities and risks for investors. However, with the right investment strategies and a disciplined approach, you can navigate these market conditions and achieve long-term investment success.

In this newsletter, we will provide you with valuable insights into Do's and Don'ts of Bull Market Vs. Bear Market. We will cover effective investing strategies during both bull and bear markets, highlight the risks and opportunities associated with both, and emphasize the importance of emotional discipline and paying attention to market indicators. By the end of this newsletter, you will better understand how to invest successfully in both market conditions.

Bullish on Growth Stocks? Keep Risks in Check with These Tips!

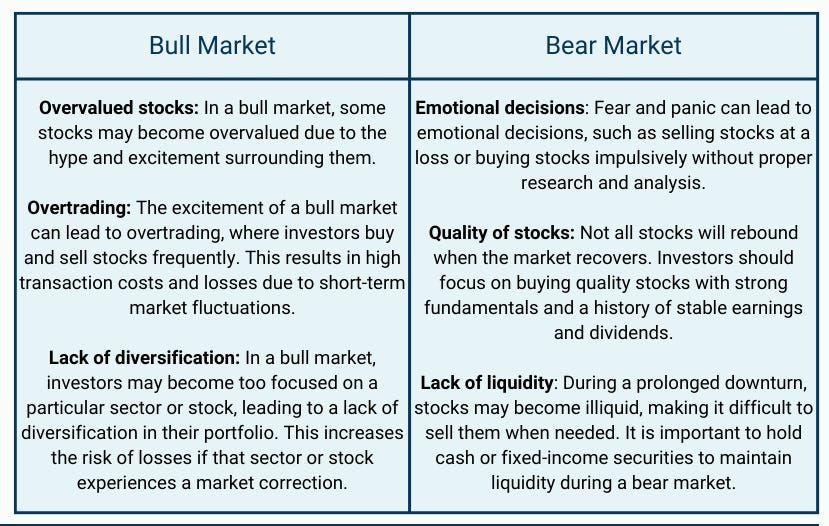

During a bull market, investors tend to become complacent and forget about the inherent risks of investing. Adopting investment strategies can help you capitalize on the market's momentum while keeping risks in check. One effective strategy is to invest in growth stocks, which tend to perform well during a bull market. However, it is essential to diversify your portfolio to reduce risk and avoid overtrading, which can lead to substantial losses.

Conduct thorough research and analysis before investing in growth stocks. Evaluate the company's fundamentals, such as earnings growth, revenue growth, and market share.

Diversify your portfolio to reduce risk, and DO NOT invest all your money in a single growth stock.

Resist the temptation to buy or sell based on short-term market fluctuations and stick to your investment strategy, and avoid overtrading.

Monitor your portfolio regularly and rebalance it as needed. If a particular stock's weightage increases due to market movements, consider selling some shares to maintain a balanced portfolio.

Avoid getting greedy and taking on excessive risk. While it can be tempting to hold onto a winning stock for too long, taking profits and maintaining a disciplined approach to investing is essential.

Bear Market Blues? Here's How to Stay Strong with Defensive Stocks!

Investors tend to panic and sell off their investments in a bear market, leading to further market declines. To avoid this, investors should adopt strategies that can help them weather the storm. One effective strategy is to invest in defensive stocks, which tend to perform well during a market downturn. It is also important to avoid overreacting to short-term fluctuations and hold cash or fixed-income securities to have liquidity during a prolonged downturn.

Look for defensive stocks that have a history of stable earnings and dividends. These stocks perform well in a bear market as investors seek safety and stability.

Consider investing in defensive sectors such as healthcare, FMCG, and IT. These sectors tend to be less affected by economic downturns and offer stability and resilience.

Avoid investing in high-risk or speculative stocks, which are more likely to experience significant declines during a bear market.

Maintain a balanced portfolio by diversifying your investments across different defensive sectors and stocks. This can help reduce risk and minimize losses.

Avoid panicking and overreacting to short-term market fluctuations. Remember that bear markets are temporary, and the market will eventually recover.

Hold cash or fixed-income securities such as bonds or treasury bills to have the liquidity advantage of buying opportunities when the market recovers.

Risks and Opportunities

Bottom Line

Remember that investing is a long-term game, and short-term fluctuations should not deter you from your investment goals. Investing in the stock market during both bull and bear markets can be a challenging but rewarding experience. As always, we recommend consulting with a financial advisor to create an investment plan tailored to your individual needs and circumstances.

Happy investing!