MSME

MSME stands for Micro, Small and Medium Enterprises. MSME industries are the backbone of the economy.

In this blog, we shall cover the following topics:

S. No.Topic

1Definition & Importance of MSME

3.MSME Schemes launched by Government

4.Registration process of MSME

5.Benefits of MSME Registration

6.Compliance for Companies with respect to MSMEs

7.Due Date for filing MSME-1 Form

8.Procedure of filing MSME-1 form by Companies

9.Penalty for Non-Filing of MSME-1

10.MSME – Disclosure requirements in Annual Statement of Accounts

11.MSME Samadhan Portal for Micro & Small Enterprises

12.FAQs

1. Definition & Importance of MSME

Any business in any form, i. e. Sole Proprietorship Firm, HUF, Partnership Firm or Company can take registration as MSME provided they comply with both of the criterias mentioned below. (applicable wef July 1, 2020)

MSME is the boon for the fresh talent in India. Let’s understand the importance of MSME through the image below:

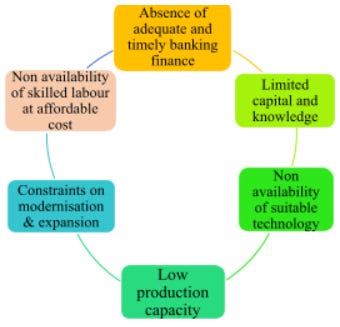

2. Challenges faced by MSME

A concerning gap in India has been the credit supply shortage to MSMEs. The main reason for this gap is the lack of formalization amongst MSMEs. Even today, out of the 6.3 crores MSMEs, only about 1.1 crores are registered with Goods and Services Tax regime. The number of income tax filers are even less.

3. MSME Schemes launched by Government

India has approximately 6.3 crore MSME’s. The number of registered MSME’s grew 18.5% Y-O-Y to reach 25.13 lakh units in 2020 from 21.21 lakh units in 2019. The Indian MSMEs sector contributes about 29% towards the GDP through its national and international trade.

4. Registration process of MSME

The persons fulfilling the conditions mentioned in point 1 can apply for registration on https://udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm. Except this portal of Government of India, no other private online or offline system, service, agency or person is authorized or entitled to do MSME Registration or undertake any of the activity related with the process.

Registration can be done under two categories:

For New Entrepreneurs who are not Registered yet as MSME and

For those having registration as UAM and for those having registration UAM through Assisted filing

For New Entrepreneurs who are not Registered yet as MSME:

Click the button “For New Entrepreneurs who are not Registered yet as MSME” shown on the home page.

Enter the Aadhaar number and the name of the entrepreneur on the opened page.

Click “Validate and Generate OTP Button”. Mention the OTP received on the registered mobile no. and press enter. Post this, PAN Verification page opens.

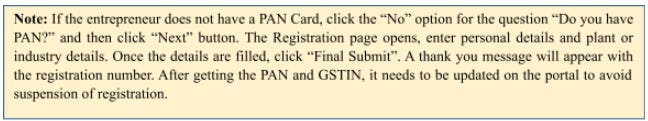

If the entrepreneur has a PAN Card, the portal gets the PAN details from the government database and details are automatically filled on the page. The ITR details are to be filled by the entrepreneur.

Once PAN details are entered, a message appears as “Udyam Registration has already been done through this PAN”, now click the “Validate PAN” button.

After verification of PAN, the Udyam Registration box appears in which the personal and plant or industry details are to be filled.

Once the details are filled, click on “Submit and Get Final OTP”, post entering and verification of the final OTP, MSME is registered and a message of successful registration with reference number will appear.

After verification of registration, which may take a few days, the Udyam Registration Certificate is issued.

Registration for Entrepreneurs already having UAM:

Click the button “For those having registration as EM-II or UAM” or “For those having registration as EM-II or UAM through Assisted filing” shown on the home page of the government portal.

Enter Udyog Aadhaar Number. Then, select an OTP option from the options of ‘obtain OTPs on mobile as filled in UAM or obtain OTP on email as filled UAM’.

Click “Validate and Generate OTP”. After entering OTP, fill registration details and udyam registration will be complete.

5. Benefits of MSME Registration

Although getting MSME registration is not mandatory, but it is always beneficial to small and medium enterprises to register themselves due to the following reasons:

*SIDBI- Small Industries Development Bank of India

6. Compliance for Companies with respect to MSMEs

Company has received goods or services from Micro & Small Enterprise.

AND

Payment is due or not paid to such Micro or Small Enterprise till 45 days from the date of acceptance or date of deemed acceptance of goods & services.

All such Companies shall file MSME Form I which shall have details of all the outstanding dues to Micro or small enterprises suppliers existing on the date of notification no. S.0 5622(E) of the order (i.e. 22 January 2019).

Note: Exemption is available to Medium Enterprises from filing Form MSME 1.

7. Due Date for filing MSME-1 Form

All the companies mentioned above shall file MSME-1 as per the below due dates:

8. Procedure of filing MSME-1 form by Companies

1) Identify your MSME registered suppliers and seek their registration certificate.

2) If there are any such registered suppliers and if the payments to them are due for more than 45 days from the date of acceptance of goods and services, then details of such suppliers shall be furnished in Form MSME-1.

3) Information required in respect of all such suppliers to be submitted in Form MSME-1:

Total outstanding amount due on 30 September/31 March (For half year period respectively)

Name of Supplier

PAN of Supplier

Date from which such amount is due

Reasons for delay in payment

9. Penalty for Non-Filing of Form MSME-1

Non-compliance will lead to punishment and penalty under section 405(4) of the Companies Act, 2013. Fine will be levied as follows:

On Company – upto Rs. 25,000

On Directors, CFO and CS – Imprisonment up to 6 Months or fine – not less than

Rs. 25,000 but upto Rs. 3,00,000 per person

10. MSME - Disclosure requirements in Annual Statement of Accounts

The companies shall comply with the following reporting requirements:

1. In the Schedule III, Part – Balance Sheet

Under the heading “Equity and Liabilities”, in para (4) for (b) Trade payables, the following shall be substituted, namely:

(b) Trade Payables:

total outstanding dues of micro enterprises and small enterprises, and

total outstanding dues of creditors other than micro enterprises and small enterprises.”

2. For Companies, in addition to the disclosures mentioned in the Schedule III of the Companies Act, 2013, the following disclosures should be given in the Notes to the financial statements of company.

3. The Interest paid on delayed payment under section 16 of the act, will be disallowed while calculating income of the assessee and the same to be reported in clause 22 of part B in Form 3CD of Tax audit report.

11. MSME Samadhan Portal for Micro & Small Enterprises

Govt. of India has introduced MSME Samadhan Portal for settlement of disputes between MSE unit and the buyer (Company) for delayed payment beyond 45 days period. The process is:

Establish Micro & Small Enterprise Facilitation Council (MSEFC) for settlement of disputes.

MSEFC issues directions to buyer unit (Company) for payment of dues along with interest.

Buyer is liable to pay compound interest with monthly rest to supplier at 3 times of bank rate notified by RBI if payment is not made within 45 days.

FAQs

Are all Micro, Small and Medium Enterprises covered under the notification number S.O 5622(E)?

Only Micro and Small Enterprises are covered under the aforesaid notification. Medium enterprises have been kept outside the purview of this notification.

Which companies are covered under the notification?

The filing requirement is applicable on ‘Specified Companies’ who satisfy both these conditions:

Purchase goods or avail services from Micro and Small enterprises AND

Whose payment cycle, while dealing with MSMEs, exceeds 45 days from the date of acceptance or the date of deemed acceptance.

Further, the classification of Specified Companies is to be done every half year to ensure submission of half yearly return to the MCA stating the outstanding amount and the reasons for delay.

Do the term outstanding dues include principal as well as interest amount?

The term “all outstanding dues” in our view, shall include both the components i.e. principal and interest, as per terms of engagement between the MSME and the Company.

Is the e-form MSME I, available on the MCA portal?

MCA released the MSME I e-Form on 1st May 2019.