New Tax Regime vs Old Tax Regime

New Tax Regime vs Old Tax Regime

Topics covered in the Blog:

Features of New Tax Regime:

New Income Tax regime under Section 115BAC was introduced in Finance Act, 2020 with the purpose of reducing tax burden on Individuals and HUF.

The new tax regime is applicable with effect from FY 2020-21, i.e., AY 2021-22.

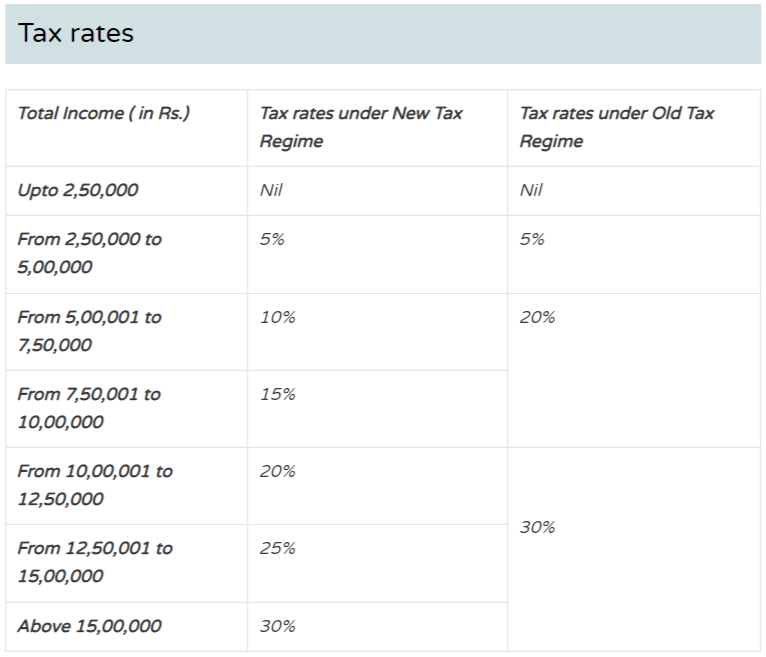

It includes more tax slabs and less tax rates. It is also known as concessional tax regime.

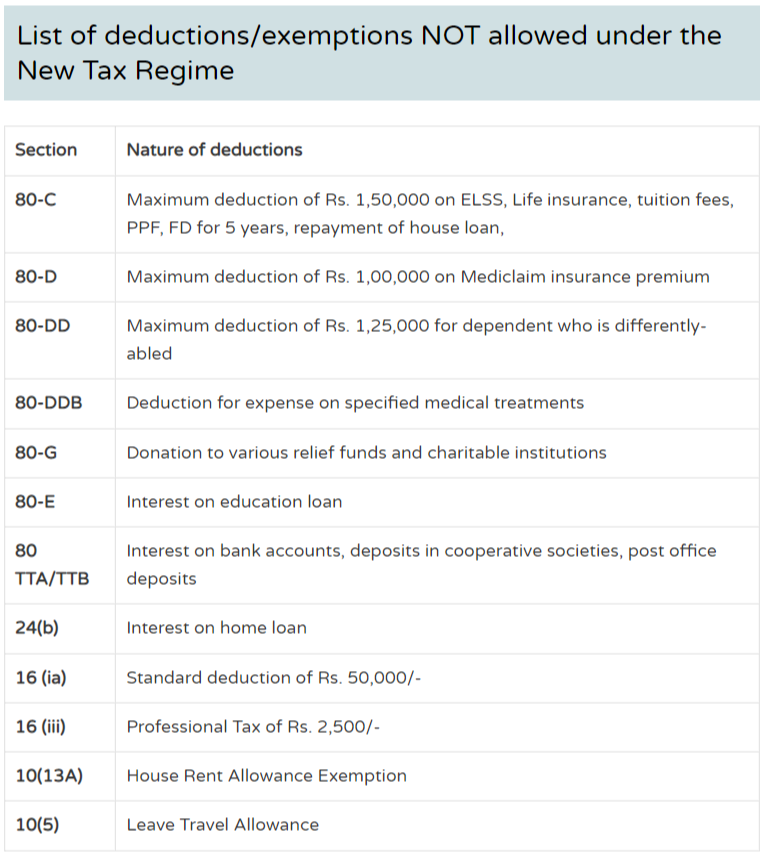

Certain deductions and exemptions allowed under old tax regime are not allowed under the new tax regime. If a person opts New Tax Regime, then he will have to forgo many deductions and exemptions.

The new regime is optional which means, even though new tax regime has been introduced, tax payers have an option to continue with existing tax regime and avail all the deductions and exemptions.

In old tax regime, tax is exempt upto Rs. 3,00,000 for individuals from 61 to 80 years of age and for individuals above 80 years of age, exemption is upto Rs. 5,00,000.

But under the New Tax Regime, tax exemption is upto Rs. 2,50,000 for all age groups.

However, certain deductions and exemptions are ALLOWED under the new tax regime which are:

A. Deduction for employer’s contribution in Notified Pension Scheme under section u/s 80CCD(2) and deduction for new employment u/s 80JJAA.

B. Special Allowances for salaried employees such as:

Transport allowance granted to a disabled employee

Conveyance allowance

Any allowance granted to meet the cost of travel on tour or on transfer

Daily allowance

C. Interest received on post office savings account u/s 10(15)(i), maximum Rs. 3,500.

Business expenditure not allowed under the new regime

Deductions and exemptions NOT allowed for business income:

a) Additional depreciation under section 32.

b) Investment allowance under section 32AD.

c) Sector-specific business deductions under section 33AB and 33ABA.

d) Expenditure on scientific research under section 35 and capital expenditure under section 35AD.

e) Exemption under section 10AA for SEZ units.

Can I choose between new and old tax regime?

As we know by now, new tax regime is only applicable for IndividualsHUF. Any other person cannot avail the new tax regime.

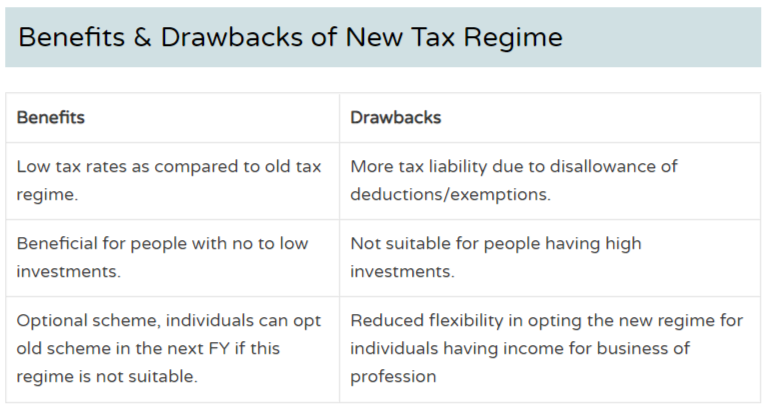

New tax regime is an optional regime, which means that an individual taxpayer can choose between new or old tax regime. Individuals can choose between the regimes every year.

However, individuals earning income from business or profession who have opted for the new regime in any year and then goes back to the old tax regime in any subsequent year, cannot opt for the new regime again and has to follow the old tax regime only.

Employees should declare the opted tax regime to their employers in the beginning of the year.

Although, the option of selection of the tax regime has to be exercised at the time of filing of ITR, but, for the purpose of deduction of taxes or payment of advance tax, this decision should be taken in the beginning of the Financial Year.

Old Tax Regime vs New Tax Regime – which is better?

This could only be understood through the help of examples:

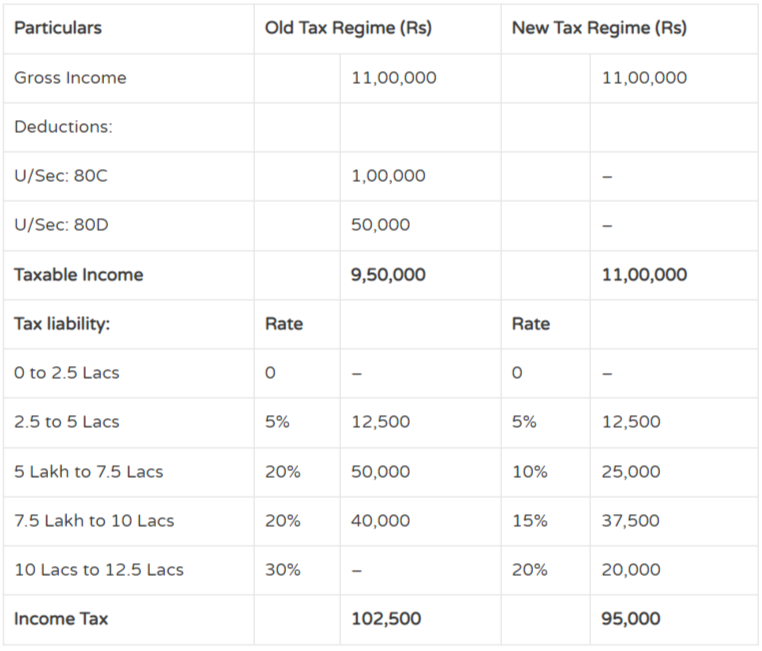

Example 1:

It can be seen that even through the individual had investments u/s 80C and 80D, tax liability as per the old regime is higher as compared to the new regime. This is due to the fact that the impact of reduced tax rates on the total tax liability under the new tax regime was more as compared to the impact of deductions due to investments under the old tax regime.

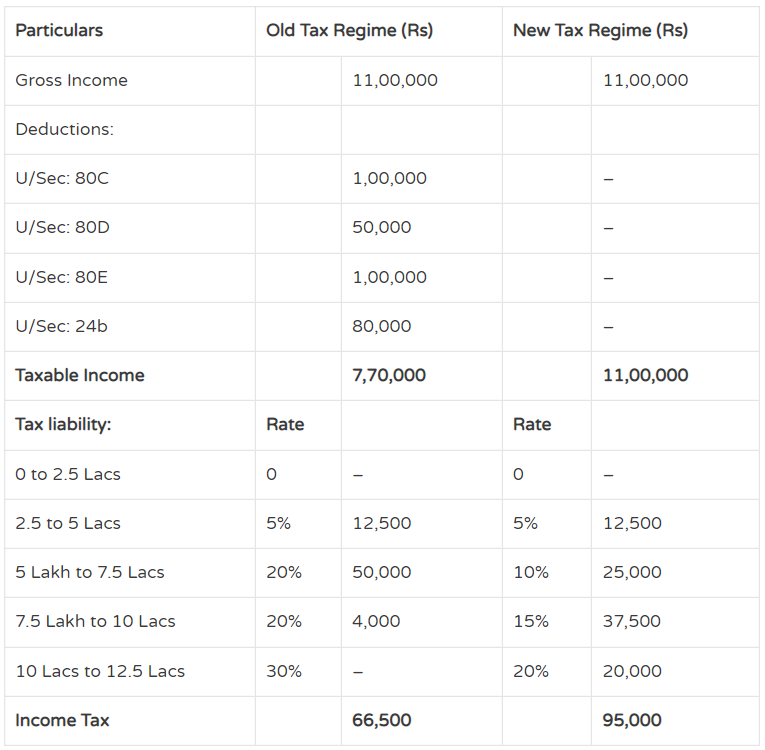

Example 2:

It can be seen that due to higher investments, tax liability under old regime is very less as compared to the new regime.

Generally, if a person does not have considerable investments during the year, he/she can opt for new regime to save more taxes.

Although, in order to decide which regime is the most suitable regime, a taxpayer should carefully analyze & calculate their income tax liability taking into account all the factors associated with each regime.