Presumptive Taxation (Section 44AD)

As per the Income-tax Act, a person engaged in business or profession is required to maintain regular books of account and further, he has to get his accounts audited. To give relief to small business man, the presumptive taxation scheme under sections 44AD, 44ADA and 44AE was framed by the Income Tax department. We will discuss Section 44AD in this blog today.

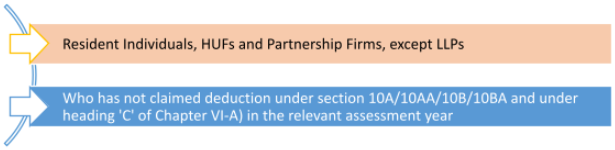

1. Who all are Eligible to opt presumptive taxation under Section 44AD?

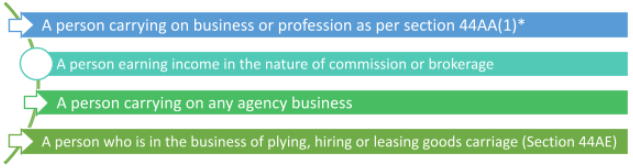

2. Who are not eligible for presumptive taxation scheme u/s 44AD?

Except from the persons mentioned above, all persons having income from business or profession are allowed to opt for presumptive taxation subject to Point 1.

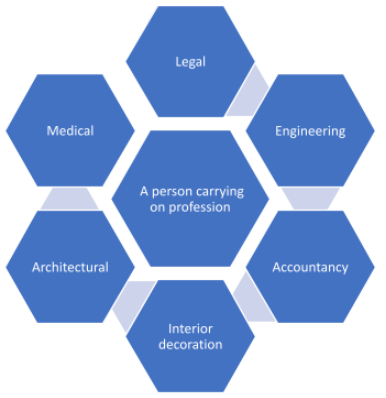

*Some examples of business of profession as per Section 44AA are:

3. Computation of Income under section 44AD

Income will be computed on presumptive basis, i.e., @ 8% of the Turnover or Gross Receipts of the eligible business for the year.

Income shall be calculated at rate of 6% in respect of Total Turnover or Gross Receipts which is received by an account payee cheque or draft or use of electronic clearing system or through such other electronic mode as may be prescribed, by the due date of filing of ROI of that relevant FY.

Turnover limit to avail the benefit of this section is Rs. 2 Crores.

Income at higher rate can be declared in the ITR.

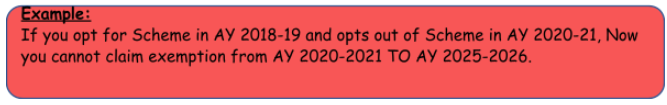

4. Consequences of not availing the benefit of this section

If income is not calculated as per this section, then assessee needs to prepare books of account u/s 44AD and also, he needs to get his books of accounts audited by CA u/s 44AB and needs to submit that report to income tax department.

In addition to above point, now assessee cannot avail the benefit of this section for next 5 FYs also. He will have to prepare the books of accounts and get them audited for next five years.

5. Expenses Deemed to Be Allowed

All expenses under section 30 to 38, including depreciation and un-absorbed depreciation are deemed to have been already allowed and no further deduction is allowed under this section.

6. Requirement of Books of Accounts

Assessee opting for the presumptive scheme are not required to maintain books of account under section 44AA and also not required to get them audited under section 44AB. However, person needs to submit amount of creditors, debtors, inventories and cash in hand while filing his ITR.

This will encourage the assessee to pay taxes without any hurdle of compliance of audit and books of accounts.

7. Requirement of Audit

Where turnover of such business exceeds Rs. 2Cr, Assessee is required to prepare books of account and get them audited by CA.

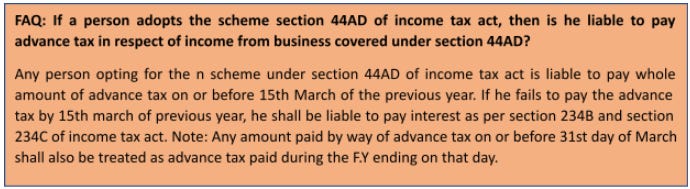

8. Advance Tax Payment

Assessee who opts for Section 44AD is now required to pay advance tax on 15th march of the previous year for which the income is to be assessed.

9. Increase in turnover limit to 10Cr

Put the point related 5% payments, 5% receipts