Quarterly Return Monthly Payment (QRMP)

The Central Board of Indirect Taxes & Customs has introduced Quarterly Return and Monthly Payment (QRMP) scheme in order to help small taxpayers. The QRMP scheme allows the taxpayers to file returns on a quarterly basis.

This Blog has covered the following points:

What is QRMP Scheme?

Applicability

When to exercise the Scheme?

How to opt for Scheme?

Return filing Process

Tax Payment

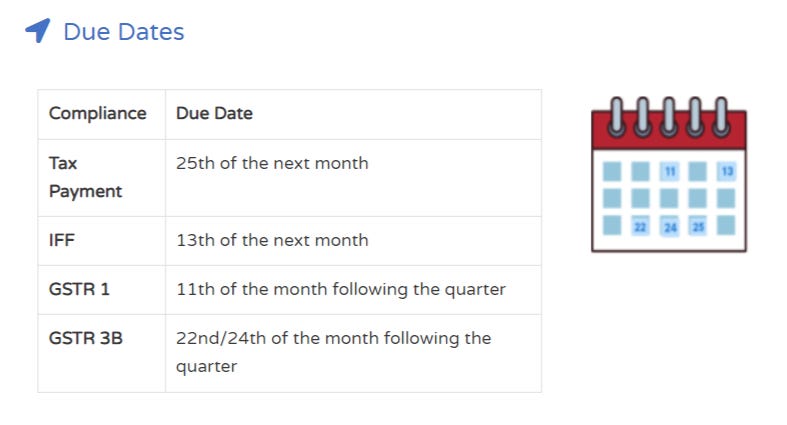

Due Dates

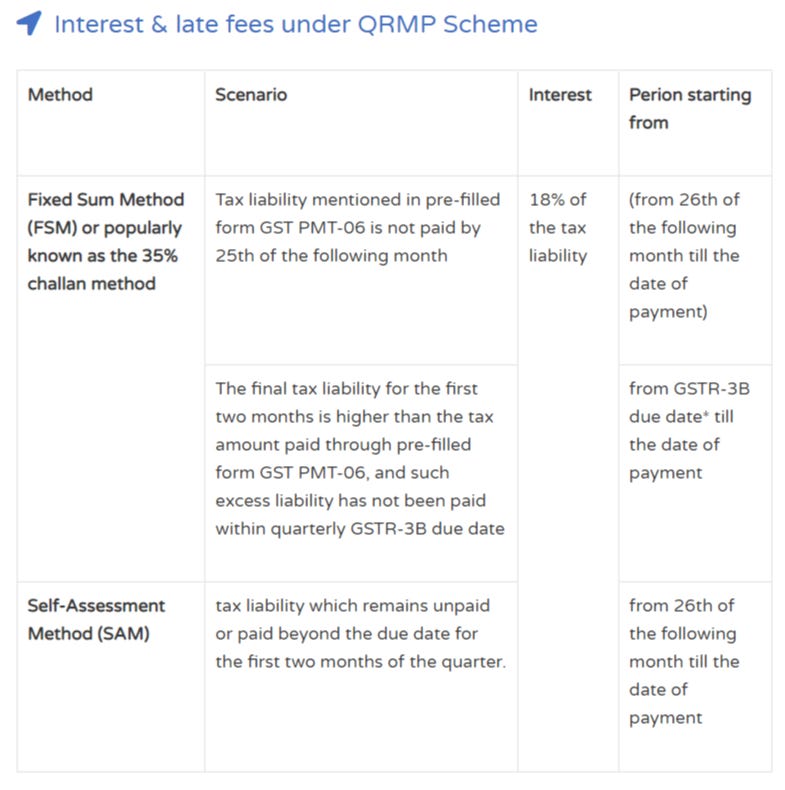

Interest & late fees

Let’s discuss one by one

What is QRMP Scheme?

As the name suggests, under QRMP scheme, a registered person can file his GSTR 1 & GSTR 3B returns on a quarterly basis and pay net taxes on monthly basis. This scheme is only applicable for eligible registered persons.

Now, the eligible persons would file only 8 returns (4 GSTR 1 and 4 GSTR 3B) in a year as compared to 24 returns per year.

Who is eligible to opt for QRMP?

Registered taxpayers having an aggregate turnover at PAN level upto Rs. 5 Crore in previous financial year can opt for quarterly filing of GSTR-1 and GSTR-3B.

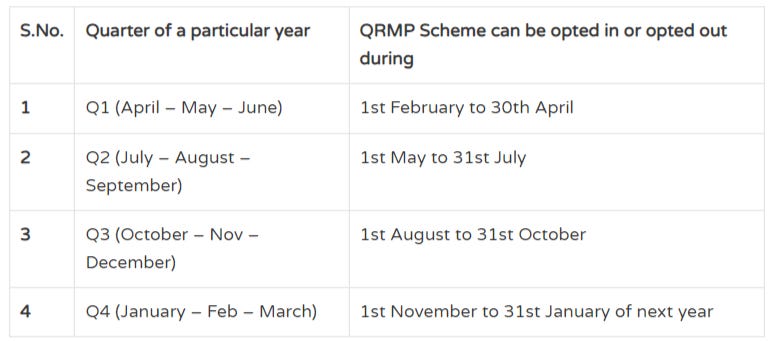

When to exercise the Scheme?

The option to avail QRMP Scheme is available on the GST portal. An eligible registered person who intends to opt QRMP, should indicate the same on the GST portal.

He can opt it from the 1st of the second month of the preceding quarter until the last day of the first month of the quarter for which such option is being exercised.

For example: If Mr. X wishes to file quarterly returns for the quarter of Apr-Jun’2021, he should opt for quarterly filing on the common GST portal between 1st February 2021 and 30th April 2021.

You can opt in or opt out of the QRMP scheme as per the timelines mentioned in the table below:

How to opt for Scheme?

Here is the step wise process to opt in for QRMP Scheme

Return filing process

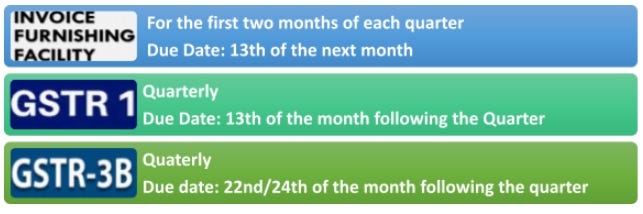

Returns required to be filed under QRMP scheme are shown below:

Now, what is Invoice Furnishing Facility?

Taxpayers who have opted for QRMP scheme can use the Invoice Furnishing Facility (IFF) to submit the B2B invoice details of sale transactions (both inter-state and intra-state) along with debit and credit notes against the B2B invoices issued during the month. B2B invoices refer to the invoices raised by the suppliers to the persons registered under GST.

This facility has been launched so that the buyers can avail the input tax credit on the purchase invoices.

Few points about IFF:

It is an optional Facility

IFF can be used only for the first two months of a quarter.

IFF has come into effect from 1st Jan 2021

The total net value of invoices that can be uploaded is restricted to Rs. 50 lakh per month.

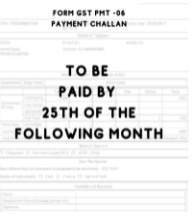

Tax payment

The taxpayer has to deposit the net tax liability using GST PMT-06 challan by the 25th of the following month, for the first and second months of the quarter. The taxpayers can pay their monthly tax liability either in the Fixed Sum Method (FSM), also popular as 35% challan method, or Self-Assessment Method (SAM).

A. Fixed Sum Method (FSM) or 35% challan method:

Example: The taxpayer has opted for QRMP scheme in Apr-Jun’21 and has opted for QRMP scheme again in July to September’21.

Case 1: For July and August’2021, the taxpayer must pay an amount of tax mentioned in the pre-filled challan in the form GST PMT-06 for an amount equal to 35% of the tax paid in cash in the previous quarter.

Case 2: However, if a taxpayer has been filing his return on a monthly basis prior to the quarter of opting the QRMP scheme, i.e., Apr-Jun’21, then he/she can opt to pay an amount equal to the tax paid in the last month of the preceding quarter.

B. Self-Assessment Method (Actual Tax Due):

Under this method, a taxpayer will pay the tax on outward supplies after taking into consideration the available input tax credit. In this case, the taxpayer will manually arrive at the tax liability and deposit the same in Form GST PMT-06. The taxpayer can refer Form GSTR-2B to arrive at the amount of ITC available.

Note: Taxpayer has to pay interest @18% if there is any late payment of tax in the third month of a quarter under both the methods.

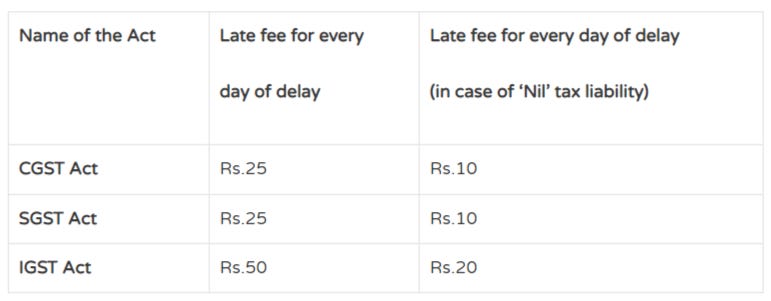

Late Fees

The late fee should be paid as follows if the quarterly GSTR-3B is not filed within due date, subject to a maximum late fee of Rs 5,000

However, it is clarified that no late fee is applicable for delay in payment of tax in the first two months of the quarter in form GST PMT-06.

Let’s understand the whole QRMP Scheme with an example

Mr. Ram deals in electronic toys having turnover of Rs. 4.5 Crore in FY 2019-20. So, he decides to opt for QRMP Scheme for Apr-Jun’21 qtr.

He can opt for QRMP Scheme between 1st Feb 2021 to 30th Apr 2021.

Suppose he opts on 1st April 2021. Now, he has to comply with the following:

File his details of Outwards supplies (B2B invoices only) in IFF for Apr’21 & May ’21 month by 13th May 2021 & 13th June 2021 respectively

Pay taxes for April’21 by 25th May 2021 and for May’21 by 25th June 2021 through GST PMT-06 challan

File GSTR 1 for Apr-Jun’21 Qtr by 11th July 2021

File GSTR 3B & pay balance tax by 22nd/24th Jul 2021.