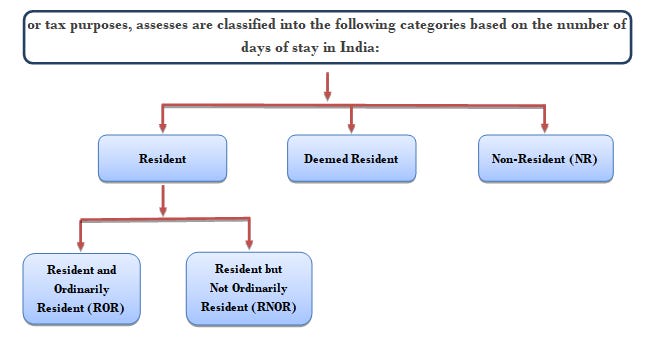

Residential Status Under Income Tax

The incidence of tax on any assessee depends upon his residential status. It plays a vital role while computing the tax liability of an individual. The residential status of an individual is not related to citizenship. In other words, Indian citizens may be residents of India or not.

The residential status of the individual is to be determined for every Assessment year. While determining the residential status, we will consider the total number of days for which the resident has stayed in India in the relevant Financial Year (it is not compulsory that a person had a continuous stay).

Note: The resident status of an assessee must be determined with reference to each year.

A person who is ROR in one year may become NR or RNOR in another year or vice versa.

A. RESIDENTIAL STATUS OF INDIVIDUALS

1. RESIDENT

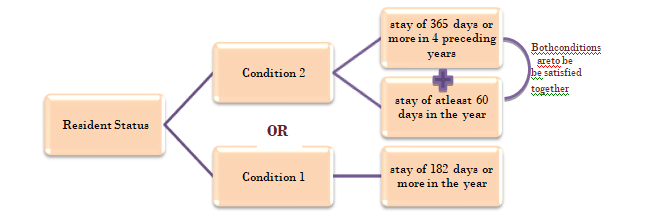

As per Section 6 of the Income Tax Act 1961, if an individual satisfies ANY ONE of the following conditions then, he is a resident in India for the year:

He has been in India during the year for a total period of 182 days or more

Or

He has been in India:

for a total period of 365 days or more during 4 years immediately preceding the year and

has been in India for at least 60 days in the year

2. NON -RESIDENT:

An individual who does not satisfy both the conditions of being a Resident, as mentioned above, shall be considered as Non-resident.