Revision of Tax Audit Report

REVISION OF TAX AUDIT REPORT

Under Section 44AB of the Income Tax Act, every person is required to get his accounts audited if his total sales, turnover, or gross receipts in business exceed Rs. 1 crore in any Previous Year.

In the case of a person carrying on profession, a tax audit is required if gross receipts from the profession exceed Rs. 50 Lakh in any Previous year

Finance Act 2021 increased the threshold limit for tax audit to Rs. 10 Crore in cases where-

a) Aggregate cash receipts during the previous year does not exceed 5% of total receipts

AND

b) Aggregate cash payments during the previous year do not exceed 5% of total payments.

If any one of the above conditions is not applicable, then, limit of Rs. 1 crore shall apply to you.

For the computation of the threshold limit of Rs. 10 Crores, the payment or receipt settled through a non-account payee cheque or non – account payee bank draft shall be deemed to be cash payment or cash receipt respectively.

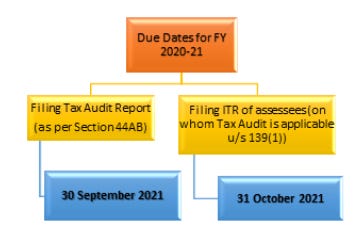

Due Dates for FY 20-21:

The due date of filing Tax audit report will be one month prior to the due date of filing the ITR of assesses on whom Tax audit is applicable

Update on Tax Audit

Prior to notification, the assessee was not allowed to revise his Audit report. But, as per Notification no. 28/2021, dated 1 April 2021, taxpayers can revise their Tax Audit report (TAR).

TAR can be revised only if any payment has been made by such assessee after furnishing of the original Tax audit report which has led to a recalculation of disallowance under Section 40 or Section 43B.

The taxpayer can revise the Tax audit report till the end of the relevant assessment year for which the return pertains.

A tax audit report can only be revised if the Taxpayer gets a revised report of audit from an accountant, duly signed and verified by such accountant.

EXAMPLE - The assessee can claim a deduction for custom duty paid while computing the taxable income under Section 43B. Before, such expenses are disallowed under Income Tax if these are not paid to the govt. before the due date of filing ITR. However, now, if such custom duty is paid to the govt. post-filing of Tax audit report but before the due date of filing ITR, then the assessee has the option to file a revised Tax Audit Report after taking the revised audit report from the accountant.

EXAMPLE - The Income Tax Act disallows certain expenses such as interest, royalty, or fee for technical services under Section 40 while computing the taxable income of an assessee if the tax is not deducted at source and paid to the govt. As per the notification, the assessee will be able to revise the tax audit report and claim allowance of the disallowed expenses in case the tax deducted at source on such expenses is paid to the govt. after filing tax audit report but before filing the ITR.

Changes incorporated in 3CD report as per the notification are:

in Appendix II, in Form 3CD

(i) in PART –A for clause 8A, the following clause shall be substituted, namely:

“8A. Whether the assessee has opted for taxation under section 115BA/115BAA/115BAB/ 115BAC/ 115BAD”?

(ii) in PART-B, for clause 17, the following clause shall be substituted, namely:

“17. Where any land or building or both is transferred during the previous year for a consideration less than value adopted or assessed or assessable by any authority of a State Government referred to in section 43CAor 50C”

Details of property

Consideration received or accrued

Value adopted or assessed or assessable

Whether provisions of the second proviso to subsection (1) of section 43CA or fourth proviso to clause (x) of sub-section (2) of section 56 applicable? (Yes/No)

(iii) in clause 18, for sub-clauses (ca) and (cb), the following sub-clauses, shall be substituted namely:-

“(ca) Adjustment made to the written down value under section 115BAC/115BAD (for the assessment year 2021-2022

only)……

(cb) The adjustment made to written down value of Intangible asset due to excluding the value of goodwill of a business or profession…..

(cc) Adjusted written down value……….”

(iv) in clause 32, for sub-clause (a), the following sub-clause shall be substituted, namely:

(a) Details of brought forward loss or depreciation allowance, in the following manner, to the extent available:

S.No.

AssessmentYear

Nature of loss/Allowance (in rupees)

Amount as returned* (in rupees)

All losses/ allowances not allowed u/s 115BAA/ 115BAC/ 115BAD

Amount as adjusted by withdrawal of additional depreciation on account of opting for taxation under section 115BAC/ 115BAD ^

Amounts assessed (give referenceto relevant order)

Remarks

*If the assessed depreciation is less and no appeal pending then take assessed.

^To be filled in for assessment year 2021-2022 only.

(v) Clause 36 to be omitted.

For detailed analysis, watch video on –

Official Notification: https://www.incometaxindia.gov.in/communications/notification/notification_28_2021.pdf