Significant Changes wef 1 April 2021

Union Finance Minister Nirmala Sitharaman presenting Union Budget 2021 had announced some significant changes in the income tax act.

Let’s have a look at the changes which came into effect from 1 April 2021.

A. Tax on Employee Provident Fund Interest

Interest on employee contribution is tax-exempt if employees contribute up to Rs. 2.5 lakh p.a. This is applicable to private-sector employees as both employee and employer have to equally contribute to EPF account as per Employees Provident Fund & Miscellaneous Act 1952.

However, where there is no employer’s contribution, then interest on employee contribution is tax-exempt if the employee contributes up to Rs.5 lakhs p.a. This is applicable to government employees as the government is as an employer do not contribute into PF account.

B. Pre-filled ITR Forms

To Further ease the filing of Income Tax returns, ITR Forms will have information of Capital Gains from Listed Securities, Dividend Income, Interest from Banks/Post offices, etc. prefilled.

C. Belated and Revised Return

Belated return u/s 139(4) and revised return u/s 139(5) can be filed up to 31 December of the relevant assessment year.

(max time is up to 9 months from the end of the previous year for which return is to be filed)

D. Tax deducted at source (TDS) and Tax collected at source (TCS)

TDS

New section 206AB has been inserted in Income Tax Act which is applicable to *specified person. As per this section, new rates of TDS will be applicable as below:

a) Twice the rate specified in the relevant provision of the act

b) Twice the rate or rates in force c) At the rate of 5%,

whichever is higher

TCS

New section 206CCA has been inserted in Income Tax Act which is applicable to *specified person. As per this section, new rates of TCS will be applicable as below:

a) Twice the rate specified in the relevant provision of the act

b) At the rate of 5%,

whichever is higher

*specified person will be one who satisfies the following conditions:

i) Person who has not filed an Income tax return for each of the 2 years immediately prior to the year in which tax is required to be deducted/collected;

ii) Time Limit of filing ITR is expired.

iii) Aggregate TDS/TCS is Rs 50,000 or more in each of 2 years.

E. Exemption from ITR filing for Senior Citizens

Exemption from the filing of Income-tax returns for Senior citizens is available only if the following conditions are satisfied:

Senior citizens who are residents and of age 75 years or more

Have only pension income and interest income from the same bank receiving his pension income.

The bank should be specified bank as notified by Govt.

He is required to furnish a declaration to the bank and the bank would compute income and deduct income tax.

F. Leave Travel Concession (LTC)

LTC exemption can now be availed on a cash allowance scheme in lieu of LTC fulfilling certain conditions:

Employees are required to spend the specified sum on goods and services that attract a GST rate of 12% or more.

Payment should be made in electronic mode.

Expenditure should be incurred between 12 October 2020 to 31 March 2021.

Amount of exemption should not exceed Rs.36,000 per person or 1/3 of specified expenditure, whichever is less.

G. E-Invoicing

E-invoicing is a system in which all the invoices generated for supplies made to a registered person (ie B2B supply) and export invoices need to be registered on the Invoice Registration Portal.

Currently, CBIC notified that e-invoicing will be mandatory for businesses with B2B transactions having a turnover of Rs. 50 cr or more.

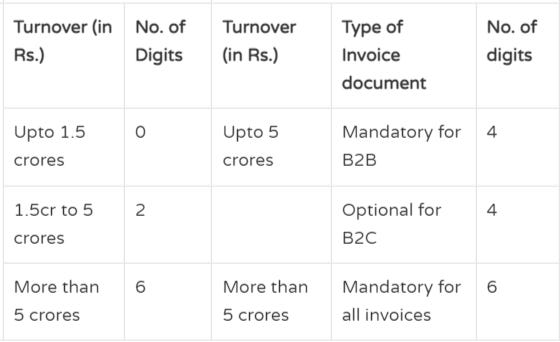

H. Harmonized System of Nomenclature Code (HSN code)

HSN system has been introduced for the systematic classification of goods all over the world.

The table below summarises the mandatory requirement for GST taxpayers to furnish HSN code:

Aggregate Turnover in the preceding financial year (in Rs.) up to 5 crores

with the type of Invoice document is Mandatory for B2B with 4 number of digits in HSN code

with the type of Invoice document is Optional for B2C with 4 number of digits in HSN code

Aggregate Turnover in the preceding financial year (in Rs.) More than 5 crores is Mandatory for all invoices with 6 number of digits in HSN code

Comparative analysis of significant changes before and after 1 April 2021 are as follows:

Tax on PF Interest

Up to 31 March, 2021 - Interest on employee and employer’s contribution is exempt

From 1 April 2021 - Interest on employee contribution is taxable over Rs. 2.5 lakh p.a. However, where there is no employer’s contribution, then the maximum amount of interest exempt from income tax is Rs.5 lakhs p.a.

Pre-filled ITR Forms

Up to 31 March 2021 - Only for Salaried person where income was reflected as per Form 16

From 1 April 2021 - Now, it will have information of Capital Gains from Listed Securities, Dividend Income, Interest from Banks/Post Office, etc.

TDS

Up to 31 March, 2021 - No such section existed for non-filers of Income Tax return (ITR).

From 1 April 2021 - New section 206AB has been inserted in Income Tax Act which is applicable to *specified person. As per this section, new rates of TDS will be applicable as below: d) Twice the rate specified in the relevant provision of act e) Twice the rate or rates in force f) At the rate of 5%, whichever is higher *specified person have been mentioned above.

TCS

Up to 31 March 2021 - No such section existed when collectee fails to furnish IT

From 1 April 2021 - New section 206CCA has been inserted in Income Tax Act which is applicable to *specified person. As per this section, new rates of TCS will be applicable as below: a) Twice the rate specified in the relevant provision of act b) At the rate of 5%, whichever is higher *specified person is same as per section 206AB

Belated and Revised Return

Up to 31 March 2021 - Belated return u/s 139(4) and revised return u/s 139(5) can be filed upto 31 March of the relevant assessment year. (max time is upto 12 months from the end of the Previous year for which return is to be filed)

From 1 April 2021 - Belated return u/s 139(4) and revised return u/s 139(5) can be filed upto 31 December of the relevant assessment year. (max time is upto 9 months from the end of Previous year for which return is to be filed)

Senior Citizens above 75 years

Up to 31 March 2021 - All senior citizens above 75 years were required to file Income tax return who had income above basic exemption limit.

From 1 April 2021 - All resident senior citizens above 75 years are exempt from filing of Income tax return if they have only pension income and interest income

Leave Travel Concession (LTC) (Cash allowance scheme only available for FY 20-21)

Up to 31 March 2021 - LTC Exemption was available on Actual Travel Cost.

From 1 April 2021 - LTC exemption can now be availed on cash allowance scheme in lieu of LTC by fulfilling certain conditions mentioned above.

E-Invoicing

Up to 31 March 2021 - E-invoicing is mandatory for business with B2B transactions having turnover of Rs. 100cr or more

From 1 April 2021 - Is mandatory for business with B2B transactions having turnover of Rs. 50 cr or more

HSN Code