Tax PlanningV2

Under Income Tax Act, there are two ways to save tax. A person can save tax by claiming exemptions & deductions for investments made. These exemptions and deductions can be claimed in the following ways:

Salary Optimization

By making tax saving investments

By claiming deduction for expenses

Deductions on certain incomes

Let’s understand one by one:

1. Salary Optimisation

An employee’s salary often comprises various allowances and reimbursements. Some of which are partially or fully tax-exempt.

From FY 2020-21, the new tax regime introduced in Budget 2020 offers lower tax rates but with almost zero tax exemptions on the allowances and reimbursements received as a part of the salary.

However, if an individual opts to continue with the existing/old tax regime, then he is eligible to claim the permissible tax exemptions on allowances received as a part of his salary.

Generally, allowances are given to employees to meet some particular requirements like house rent, uniform expenses, conveyance etc. Under the Income Tax Act, 1961, there are allowances which are fully taxable, partly taxable and fully exempt from taxes.

Here we will discuss all such allowances, which are partly taxable and you can claim exemption on them.

House rent allowance [Section 10(13A)]: HRA is a special allowance specifically granted to an employee by his employer towards payment of rent for residence of the employee. HRA granted to an employee is exempt to the extent of least of the following-

Metro Cities (i.e., Delhi, Kolkata, Mumbai, Chennai)Other CitiesHRA actually received for the relevant period HRA actually received for the relevant period Rent paid (-) 10% of salary for the relevant period Rent paid (-) 10% of salary for the relevant period50% of salary for the relevant period40% of salary for the relevant period

Notes:

Exemption is not available to an assessee who lives in his own house, or in a house for which he has not incurred the rent expenditure

Salary = Basic + Dearness Allowance

Special allowance:

Special allowances are granted to meet expenses incurred wholly, necessarily and exclusively in the performance of the duties of an office or employment of profit.

For the allowances under this category, there is no limit on the amount which the employee can receive from the employer, but whatever amount is received should be fully utilized for the purpose for which it was given to him.

Allowances covered under this category:

Travelling allowance granted to meet the cost of travel on tour or on transfer.

Daily Allowance whether granted on tour or for the period of journey in connection with transfer, to meet the ordinary daily charges incurred by an employee on account of absence from his normal place of duty.

Conveyance Allowance granted to meet the expenditure incurred on conveyance in performance of duties of an office or employment of profit.

Helper Allowance granted to meet the expenditure incurred on a helper where such helper is engaged in the performance of the duties of an office or employment of profit.

Research Allowance granted for encouraging the academic, research and training pursuits in educational and research institutions.

Uniform Allowance granted to meet the expenditure on the purchase or maintenance of uniform for wear during the performance of the duties of an office or employment of profit.

Special allowances granted to the assessee either to meet his personal expenses at the place where the duties of his office or employment of profit are ordinarily performed by him or at the place where he ordinarily resides or to compensate him for the increased cost of living.

For the allowances under this category, there is a limit on the amount which the employee can receive from the employer. Any amount received by the employee in excess of these specified limits will be taxable in his hands as income from salary for the year.

It does not matter whether the amount which is received is actually spent or not by the employee for the purpose for which it was given to him

Main Allowances covered under this category are:

2. By Making Tax Saving investments

The Income Tax Act prescribes various sections through which a taxpayer can claim deductions for various investments, savings and expenditure incurred by the taxpayer in a particular financial year. We will discuss some of the avenues which can help you save taxes.

(I) Investments under section 80C

Section 80C is one of the most popular section amongst the taxpayers as it allows to reduce taxable income by making tax saving investments or incurring eligible expenses. It allows a maximum deduction of Rs 1.5 lakh every year from the taxpayer’s total income. The benefit of this deduction can be availed by Individuals and HUFs only.

The following are the investments/contributions eligible for deduction:

(III) Contribution to Certain Pension funds (Section 80CCC)

An individual can claim deduction of upto Rs. 1,50,000 if he has deposited any amount in any annuity plan of LIC of India or any other insurer for receiving pension from the fund set up by LIC or such other insurer.

(III) Deduction for contribution in pension scheme notified by central government [Section 80CCD]

Self-employed individual-20% of gross total income in the PY

The deduction u/s 80CCD(1) is subject to the overall limit of Rs. 1,50,000

Under section 80CCD(2), contribution made by the Central Government or any other employer in the previous year to the said account of an employee, is allowed as a deduction in computation of the total income of the assessee.

Section 80CCD(1B) provides for an additional deduction of upto Rs. 50,000 in respect of the amount paid under NPS, whether or not deduction is allowed u/s 80CCD(1)

Limit on deduction under section 80C, 80CCC & 80CCD(1) [Section 80CCE]

This section restricts the aggregate amount of deduction under section 80C, 80CCC and 80CCD(1) to Rs.1,50,000.

It may be noted that the deduction of upto Rs. 50,000 u/s 80CCD(1B) and employer’s contribution to pension scheme, allowable as deduction u/s 80CCD(2) in the hands of the employee, would be outside the overall limit of Rs.1,50,000 stipulated under section 80CCE.

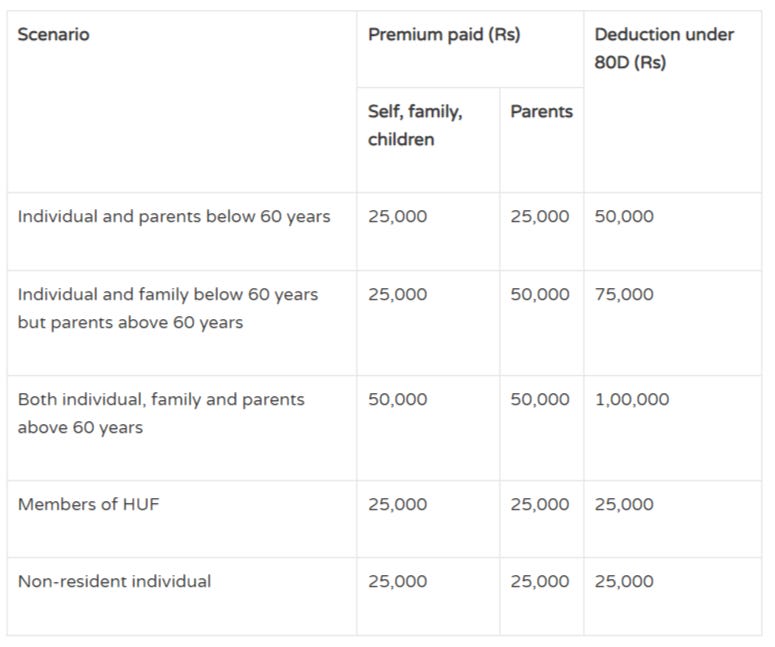

(IV) Medical Insurance Premium- (Section 80D)

Every individual or HUF can claim a deduction from their total income under section 80D for medical insurance premium paid for self, family & parents

Section 80D provides that deduction to the extent of Rs. 5,000 shall be allowed in respect payment made on account of

preventive health check-up of

self, spouse, dependent children or parents during the previous year

the deduction of Rs. 5,000 is within the overall limit of Rs.25,000 or Rs.50,000, as the case maybe.

Mode of payment: For claiming deduction under section 80D, the payment can be made:

in any mode, including cash, in respect of any sum paid on account of preventive health check-up;

by any mode other than cash, in all other cases.

(V) Deduction for premium for health insurance paid in lump sum [Section 80D (4A)]

In a case where Mediclaim premium is paid in lumpsum for more than one year by an individual for insurance on his health or health of his spouse, dependent children or parents;

Or

a HUF, for an insurance on the health of any member of the family

Then, proportionate deduction would be allowed for each of the relevant previous year during which the insurance would be in force.

3. By claiming deduction for expenses made

(I) Deduction for Interest paid on housing loan

(a) Section 24

A home loan must be taken for the purchase/construction of a house and the construction of the house must be completed within 5 years from the end of financial year in which loan was taken.

If you are paying EMI for the housing loan, it has two components – interest payment and principal repayment.

The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh u/s 24.

The maximum deduction for interest paid on Self Occupied house property is Rs 2 Lakh.

For let out property, there is no upper limit for claiming interest.

However, the overall loss one can claim under the head of House Property is restricted to Rs 2 lakh only. This Deduction can be claimed from the year in which construction of the house is completed.

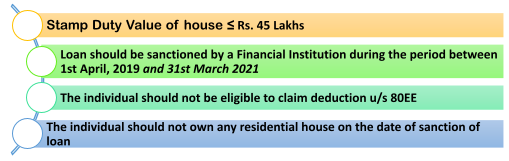

(b) Section 80EEA

An individual who has taken a loan for acquisition of residential house property from any financial institution.

Conditions

The benefit of deduction under this section would be available from A.Y. 2020-21 and subsequent assessment years till the repayment of loan continues.

The maximum deduction allowable is Rs. 1,50,000. The deduction of upto Rs. 1,50,000 under section 80EEA is over and above the deduction available under section 24 in respect of interest payable on loan borrowed for acquisition of a residential house property.

(II) Deduction on Principal Payment

The principal portion of the EMI paid for the year is allowed as deduction under Section 80C. The maximum amount that can be claimed is up to Rs 1.5 lakh.

But to claim this deduction, the house property should not be sold within 5 years of possession.

Otherwise, the deduction claimed earlier will be added back to your income in the year of sale.

(III) Deduction for Stamp Duty and Registration Charges

Besides claiming the deduction for principal repayment, a deduction for stamp duty and registration charges can also be claimed u/s 80C but within the overall limit of Rs. 150,000.

However, it can be claimed only in the year in which these expenses are incurred.

(IV) Deduction u/s 80C is allowed for payment of tuition fees to any university, college, school or other educational institution within India for full time education for maximum 2 children.

(V) Deduction for maintenance including medical treatment of a dependant disabled [Section 80DD]

This section provides deduction to a resident individual or Hindu undivided family on amount incurred for medical treatment (including nursing), training and rehabilitation of a dependant, being a person with disability

The dependant can be spouse, children, parents, brothers and sisters of the taxpayer.

The tax deduction amount will also cover insurance premium paid to specific insurance plans designed for a disabled dependent.

Quantum of Deduction:

Dependant person with disability: A dependant person with disability is one who has at least 40% of any of the specified disability. The person who looks after the medical charges of the dependant person with disability can claim a maximum tax deduction of Rs. 75,000.

Quantum of Deduction:

Dependant person with disability: A dependant person with disability is one who has at least 40% of any of the specified disability. The person who looks after the medical charges of the dependant person with disability can claim a maximum tax deduction of Rs. 75,000.

Dependant person with severe disability: A dependant person with severe disability is one who has at least 80% of any disability. The person handling the medical expenses of dependant person with severe disability can claim a maximum tax deduction of Rs. 1,25,000.

(VI) Deduction in respect of medical treatment [Section 80DDB]

This section provides deduction to a resident individual or Hindu undivided family in respect of medical expenditure

The deduction is available to an individual for medical expenditure incurred on himself or a dependant. It is also available to a Hindu undivided family (HUF) for such expenditure incurred on any of its members.

Quantum of Deduction:

The taxpayer is eligible to claim tax deduction of Rs. 40,000 or the actual amount paid, whichever is lower.

Senior citizens above the age of 60 years are eligible for tax deduction of Rs. 1,00,000 or amount actually paid, whichever is lower.

(VII) Interest on loan taken for higher education [Section 80E]

Section 80E provides deduction to an individual-assessee in respect of any interest on loan paid by him

The loan must have been taken for pursuing his higher education or for the purpose of higher education of his or her relative. The loan must have been taken from any financial institution or approved charitable institution

Amount of deduction: The repayment of Interest paid on Education Loan is eligible for deduction and moreover there is no cap on the amount to be deducted. The entire interest amount can be deducted from the taxable income.

Education Loan should have been taken for the purpose of pursuing higher studies of Individual, Spouse, Children of Individual or of the student of whom individual is legal Guardian. Hence parents are also eligible to claim deduction of interest paid by them on loan taken for their children’s education

(VII) Interest on loan taken for higher education [Section 80E]

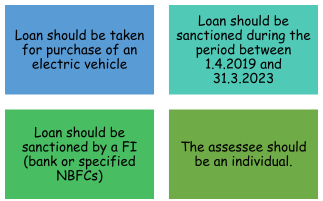

An individual who has taken a loan for purchase of an electric vehicle from any financial institution. Interest payable on such loan would qualify for deduction under this section.

Conditions:

The benefit of deduction under this section would be available from A.Y. 2020-21 and subsequent assessment years till the repayment of loan continues.

Quantum of deduction: Interest payable, subject to a maximum of Rs.1,50,000.

(IX) Deduction in respect of donations to certain funds, charitable institutions etc [Section 80G]

Donations made to certain prescribed funds or institutions, can be claimed as deduction under Section 80G of the Income Tax Act. This deduction can be claimed by any taxpayer – individuals, company, firm or any other person.

Quantum of Deduction: deduction under this section is allowed under four categories:

Donation qualifying for 100 % deduction

Donation qualifying for 50% deduction

Donations Eligible for 100% Deduction Subject to 10% of Adjusted Gross Total Income

Donations Eligible for 50% Deduction Subject to 10% of Adjusted Gross Total Income

This deduction can only be claimed when the contribution has been made via a cheque or a draft or in cash.

But the deduction is not allowed for donations made in cash exceeding Rs 2,000.

In-kind contributions such as food, material, clothes, medicines etc. do not qualify for deduction under section 80G.

(X) Deduction for rent paid [Section 80GG]

An individual who is not receiving HRA and who pays rent for accommodation occupied by him for residential purpose can claim deduction u/s 80GG of the Income Tax Act

Quantum of Deduction: Lowest of the following-

Rs. 5,000 per month

Actual rent – 10% of the total income before allowing deduction

25% of such total income arrived after making all deduction u/s 80C to 80U except section 80GG

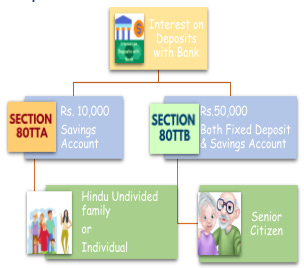

4. Deductions on certain incomes

Interest on deposits

Conclusion: Every tax payer should claim maximum benefits of exemption and deduction provisions provided under Income Tax Act in order to save tax.