Tips to Improve your Credit Score

First of all, we need to know what is a credit score.

A credit score also known as credit rating is an indicator of a person’s financial health or creditworthiness, or their ability to repay debt.

In India, there are four Credit Information Companies (CICs) licensed by RBI viz, CIBIL, Equifax, Experian, and Highmark.

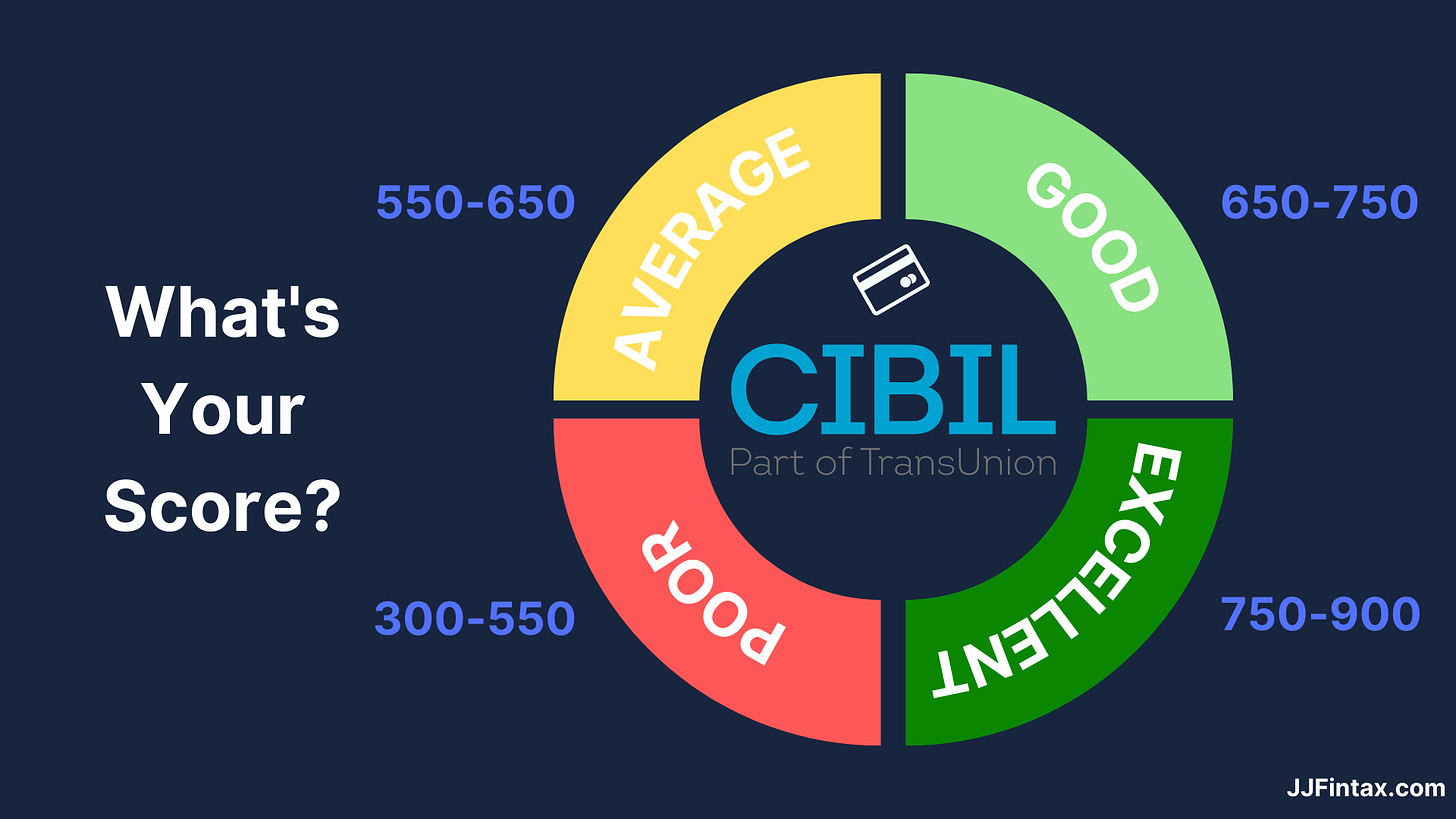

The most popular among these is the CIBIL rating. The CIBIL score is a three-digit number ranging from 300 to 900, with 900 being the best score.

Have a low credit score? How to improve it?

It pays to have a good credit score. A high credit rating can get you better and quicker loans. If you are somebody who doesn’t know their credit score or how to improve it to maintain your financial health, this article will help you with certain tactics to build your credit score.

Why a Credit score is Important?

The simple answer to this is - It reveals the creditworthiness of an individual to financial institutions. This is the first thing the lenders check when an individual applies for a loan.

It basically tells the lenders how responsibly one uses their credit. The better the credit score, the higher are the chances of getting your loan approved. Numerous other advantages are linked with high credit scores such as lower interest rates, higher credit card limits, and much more.

Banks or other financial institutions usually do not lend money to people with lower credit ratings fearing credit risk or default in repayments.

And if by any chance a person with a low credit score gets a loan or a credit card, it is quite possible that he might have to pay a high rate of interest. So, one must take conscious measures to improve their credit score.

There are “n” number of tips and tricks to improve one’s credit score but at times it can be a bit difficult to understand, where to start from. No matter a person is starting to build their score from scratch or is rebuilding, it’s significant to know how credit scores are calculated.

Your credit score is calculated by taking into account several factors and each factor has a different weightage attached to it. The factors under consideration include the following:

Repayment history

Total amount owed

Credit utilization

Number of loans and credit cards used

It’s possible to improve one’s credit score by following a few tips and tricks like - Paying bills on a timely basis, using credit cards prudently, paying your minimum balance due on time, and much more.

Mentioned below are some of the measures that can help you to maintain a good and reliable credit score.

1. Pay down your revolving credit balances

If you are having sufficient funds or can afford to pay more than your minimum payment every month then you should do this. This will basically help in keeping your credit utilization rate low. In simple words, the sooner you can pay off your balance each month, the better it would be.

2. Manage your bill payments wisely

Lenders generally see 4-5 factors that are – Payment history, credit usage, age of credit accounts, new credit inquiry, and credit mix.

Avoid late payments at any cost and manage your credit. You must pay your dues timely.

You can make a planner or mark a calendar with your payment deadlines and set up reminders so that you don’t miss the deadlines. Also, use the service that lets you automate bill payments to avoid any delay. If you are consistent in paying your dues timely, there are high chances that the credit score might hike within just a few months.

3. Consolidate your debt

One basic tactic is to consolidate your multiple outstanding debts into one and pay them all together by taking a debt consolidation loan from the bank. Then you’ll just have one debt to deal with and there might be a chance to get a lower interest rate on the loan. This will ultimately help in maintaining your credit score.

One can also consolidate their multiple credit card balances and pay them off with a balance transfer credit card.

4. Avoid taking too much debt at one time

The number of loans you apply for, during a fixed time period should be minimal. Repay one loan and then take another loan to keep your credit score from crashing. If you apply for multiple loans at one time, it would depict that you are in an unforgiving cycle where you do not have sufficient funds.

5. Avoid closing unused Credit Cards

It is always recommended to maintain your credit card accounts and avoid closing them as the age of credit history also matters and longer credit history is always better as it impacts your credit score.

6. Review your Credit Report

You must ensure to check your credit report from time to time. This will help you identify any discrepancy or any error and take corrective measures to resolve them by submitting a CIBIL dispute resolution form online. There are chances of error affecting your credit score.

7. Be careful while paying old debts

You should be very careful while paying your old debts because one of the common mistakes that people make is that they pay a “charged off” account. Charged off basically means when the creditor is not expecting any further payments. If a person pays this then it eventually lowers your credit score.

8. Pay attention to Credit Utilization

Credit utilization refers to the portion of your credit limit that you’re using at any given time. Keeping a check on your credit utilization ratio is a major factor that affects your credit score. The simplest way to keep your credit utilization in check is to pay your credit card balances in full each month.

Let us understand this with the help of an example. Let us assume that you have a total available credit limit of Rs10,000 on two credit cards, and a balance of Rs6000 on one, this implies that your credit utilization rate is 60% i.e., you are using 60% of that total credit available.

The Conclusion

It is essential to note that there won’t be a sudden change or improvement in your credit score. You will have to follow the above-mentioned steps consistently to build your credit score.

Also, remember there is no single solution that fits everyone as every person has their own unique credit journey. Keep a tab on your financial health and stay secure.